-

North Korea's Kim tours hot tubs, BBQ joints at lavish new mountain resort

North Korea's Kim tours hot tubs, BBQ joints at lavish new mountain resort

-

Asian markets rally again as rate cut hopes bring Christmas cheer

-

Australian state poised to approve sweeping new gun laws, protest ban

Australian state poised to approve sweeping new gun laws, protest ban

-

Trapped under Israeli bombardment, Gazans fear the 'new border'

-

Families want answers a year after South Korea's deadliest plane crash

Families want answers a year after South Korea's deadliest plane crash

-

Myanmar's long march of military rule

-

Disputed Myanmar election wins China's vote of confidence

Disputed Myanmar election wins China's vote of confidence

-

Myanmar junta stages election after five years of civil war

-

Ozempic Meals? Restaurants shrink portions to match bite-sized hunger

Ozempic Meals? Restaurants shrink portions to match bite-sized hunger

-

'Help me, I'm dying': inside Ecuador's TB-ridden gang-plagued prisons

-

Australia's Cummins, Lyon out of fourth Ashes Test

Australia's Cummins, Lyon out of fourth Ashes Test

-

US singer Barry Manilow reveals lung cancer diagnosis

-

'Call of Duty' co-creator Vince Zampella killed in car crash

'Call of Duty' co-creator Vince Zampella killed in car crash

-

Trump says would be 'smart' for Venezuela's Maduro to step down

-

Steelers' Metcalf suspended two games over fan outburst

Steelers' Metcalf suspended two games over fan outburst

-

Salah, Foster take Egypt and South Africa to AFCON Group B summit

-

Napoli beat Bologna to lift Italian Super Cup

Napoli beat Bologna to lift Italian Super Cup

-

Salah snatches added-time winner for Egypt after Zimbabwe scare

-

Penalty king Jimenez strikes for Fulham to sink Forest

Penalty king Jimenez strikes for Fulham to sink Forest

-

Kansas City Chiefs confirm stadium move

-

Liverpool rocked by Isak blow after surgery on broken leg

Liverpool rocked by Isak blow after surgery on broken leg

-

Liverpool rocked by Isak blow after surgery on ankle injury

-

US stocks push higher while gold, silver notch fresh records

US stocks push higher while gold, silver notch fresh records

-

Deadly clashes in Aleppo as Turkey urges Kurds not to be obstacle to Syria's stability

-

Is the United States after Venezuela's oil?

Is the United States after Venezuela's oil?

-

Trump admin halts US offshore wind projects citing 'national security'

-

Right wing urges boycott of iconic Brazilian flip-flops

Right wing urges boycott of iconic Brazilian flip-flops

-

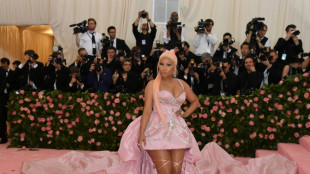

From misfits to MAGA: Nicki Minaj's political whiplash

-

Foster grabs South Africa winner against Angola in AFCON

Foster grabs South Africa winner against Angola in AFCON

-

Russia pledges 'full support' for Venezuela against US 'hostilities'

-

Spotify says piracy activists hacked its music catalogue

Spotify says piracy activists hacked its music catalogue

-

Winter Olympics organisers resolve snow problem at ski site

-

Fuming Denmark summons US ambassador over Greenland envoy

Fuming Denmark summons US ambassador over Greenland envoy

-

UK's street artist Banksy unveils latest mural in London

-

Rugby players lose order challenge in brain injury claim

Rugby players lose order challenge in brain injury claim

-

UK singer Chris Rea dies at 74, days before Christmas

-

Last of kidnapped Nigerian pupils handed over, government says

Last of kidnapped Nigerian pupils handed over, government says

-

Zambia strike late to hold Mali in AFCON opener

-

Outcry follows CBS pulling program on prison key to Trump deportations

Outcry follows CBS pulling program on prison key to Trump deportations

-

Sri Lanka cyclone caused $4.1 bn damage: World Bank

-

Billionaire Ellison offers personal guarantee for son's bid for Warner Bros

Billionaire Ellison offers personal guarantee for son's bid for Warner Bros

-

Tech stocks lead Wall Street higher, gold hits fresh record

-

Telefonica to shed around 5,500 jobs in Spain

Telefonica to shed around 5,500 jobs in Spain

-

Cambodia says Thailand launches air strikes after ASEAN meet on border clashes

-

McCullum wants to stay as England coach despite Ashes drubbing

McCullum wants to stay as England coach despite Ashes drubbing

-

EU slams China dairy duties as 'unjustified'

-

Italy fines Apple nearly 100 mn euros over app privacy feature

Italy fines Apple nearly 100 mn euros over app privacy feature

-

America's Cup switches to two-year cycle

-

Jesus could start for Arsenal in League Cup, says Arteta

Jesus could start for Arsenal in League Cup, says Arteta

-

EU to probe Czech aid for two nuclear units

Europe stocks rise before US earnings

European equities rose Friday as traders awaited the latest US bank results at the end of yet another volatile week for markets.

The euro held above $1, having sunk below parity this week on fears Russia would cut off Europe's gas supplies in retaliation for Ukraine war sanctions, pushing the region into recession.

Oil prices rebounded having slumped Thursday on renewed fears of a global recession that would dend demand for energy.

Hong Kong and Shanghai stocks slid as weak Chinese second-quarter GDP compounded anxiety about a fragile global recovery.

Later Friday, investors will digest earnings from financial big-hitters Citigroup and Wells Fargo, with Bank of America and Goldman Sachs due Monday.

- 'Bruising week' -

"The firmer tone across Europe is... ahead of major US earnings, after what has been another bruising week for risk assets," City Index analyst Fawad Razaqzada told AFP.

Global equities had mostly fallen Thursday as fresh evidence of runaway global inflation ramped up expectations of more aggressive rate hikes by central banks, while disappointing earnings revived recession fears.

Wall Street stumbled Thursday with sentiment weighed by the disappointing reports from JPMorgan Chase & Co. and Morgan Stanley.

That compounded worries that companies' profits would be hit by the fallout from a number of issues including rocketing consumer prices, monetary policy tightening and the war in Ukraine.

Markets took a major knock this week from news that US inflation zoomed to a 40-year high of 9.1 percent in June on energy costs.

After rate hikes by several countries this week, investors now expect the Federal Reserve to lift rates this month by 75 basis points as officials battle decades-high inflation, though some observers suggest a one-percentage-point move could even be on the cards.

While experts warn that raising US rates risks hammering the economy, the Fed has made it clear its number-one priority is bringing down prices.

This has sent the dollar racing ahead, particularly as the European Central Bank has yet to lift interest rates -- leaving it well behind the Fed.

In Asia, Hong Kong and mainland Chinese equity markets led losses after data showed China's economy grew just 0.4 percent in the second quarter as it was battered by Covid lockdowns in major cities including Shanghai and Beijing.

The reading was well off the 1.6-percent growth predicted by analysts in an AFP survey.

Elsewhere, traders are keeping tabs on US President Joe Biden's visit to the Middle East as he tries to persuade Saudi Arabia to bring down high oil prices by pumping more crude.

- Key figures at around 1110 GMT -

London - FTSE 100: UP 0.6 percent at 7,082.73 points

Frankfurt - DAX: UP 1.3 percent at 12,682.56

Paris - CAC 40: UP 0.3 percent at 5,936.38

EURO STOXX 50: UP 0.8 percent at 3,423.92

Tokyo - Nikkei 225: UP 0.5 percent at 26,788.47 (close)

Hong Kong - Hang Seng Index: DOWN 2.2 percent at 20,297.72 (close)

Shanghai - Composite: DOWN 1.6 percent at 3,228.06 (close)

New York - Dow: DOWN 0.5 percent at 30,630.17 (close)

Euro/dollar: UP at $1.0038 from $1.0022 Thursday

Pound/dollar: UP at $1.1828 from $1.1826

Euro/pound: DOWN at 84.86 pence from 84.72 pence

Dollar/yen: UP at 139.28 yen from 138.93 yen

West Texas Intermediate: UP 0.1 percent at $95.88 per barrel

Brent North Sea crude: UP 0.7 percent at $99.79 per barrel

A.Ruiz--AT