-

Asian markets rally again as rate cut hopes bring Christmas cheer

Asian markets rally again as rate cut hopes bring Christmas cheer

-

Australian state poised to approve sweeping new gun laws, protest ban

-

Trapped under Israeli bombardment, Gazans fear the 'new border'

Trapped under Israeli bombardment, Gazans fear the 'new border'

-

Families want answers a year after South Korea's deadliest plane crash

-

Myanmar's long march of military rule

Myanmar's long march of military rule

-

Disputed Myanmar election wins China's vote of confidence

-

Myanmar junta stages election after five years of civil war

Myanmar junta stages election after five years of civil war

-

Ozempic Meals? Restaurants shrink portions to match bite-sized hunger

-

'Help me, I'm dying': inside Ecuador's TB-ridden gang-plagued prisons

'Help me, I'm dying': inside Ecuador's TB-ridden gang-plagued prisons

-

Australia's Cummins, Lyon out of fourth Ashes Test

-

US singer Barry Manilow reveals lung cancer diagnosis

US singer Barry Manilow reveals lung cancer diagnosis

-

'Call of Duty' co-creator Vince Zampella killed in car crash

-

Trump says would be 'smart' for Venezuela's Maduro to step down

Trump says would be 'smart' for Venezuela's Maduro to step down

-

Steelers' Metcalf suspended two games over fan outburst

-

Salah, Foster take Egypt and South Africa to AFCON Group B summit

Salah, Foster take Egypt and South Africa to AFCON Group B summit

-

Napoli beat Bologna to lift Italian Super Cup

-

Salah snatches added-time winner for Egypt after Zimbabwe scare

Salah snatches added-time winner for Egypt after Zimbabwe scare

-

Penalty king Jimenez strikes for Fulham to sink Forest

-

Kansas City Chiefs confirm stadium move

Kansas City Chiefs confirm stadium move

-

Liverpool rocked by Isak blow after surgery on broken leg

-

Liverpool rocked by Isak blow after surgery on ankle injury

Liverpool rocked by Isak blow after surgery on ankle injury

-

US stocks push higher while gold, silver notch fresh records

-

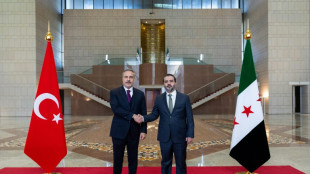

Deadly clashes in Aleppo as Turkey urges Kurds not to be obstacle to Syria's stability

Deadly clashes in Aleppo as Turkey urges Kurds not to be obstacle to Syria's stability

-

Is the United States after Venezuela's oil?

-

Trump admin halts US offshore wind projects citing 'national security'

Trump admin halts US offshore wind projects citing 'national security'

-

Right wing urges boycott of iconic Brazilian flip-flops

-

From misfits to MAGA: Nicki Minaj's political whiplash

From misfits to MAGA: Nicki Minaj's political whiplash

-

Foster grabs South Africa winner against Angola in AFCON

-

Russia pledges 'full support' for Venezuela against US 'hostilities'

Russia pledges 'full support' for Venezuela against US 'hostilities'

-

Spotify says piracy activists hacked its music catalogue

-

Winter Olympics organisers resolve snow problem at ski site

Winter Olympics organisers resolve snow problem at ski site

-

Fuming Denmark summons US ambassador over Greenland envoy

-

UK's street artist Banksy unveils latest mural in London

UK's street artist Banksy unveils latest mural in London

-

Rugby players lose order challenge in brain injury claim

-

UK singer Chris Rea dies at 74, days before Christmas

UK singer Chris Rea dies at 74, days before Christmas

-

Last of kidnapped Nigerian pupils handed over, government says

-

Zambia strike late to hold Mali in AFCON opener

Zambia strike late to hold Mali in AFCON opener

-

Outcry follows CBS pulling program on prison key to Trump deportations

-

Sri Lanka cyclone caused $4.1 bn damage: World Bank

Sri Lanka cyclone caused $4.1 bn damage: World Bank

-

Billionaire Ellison offers personal guarantee for son's bid for Warner Bros

-

Tech stocks lead Wall Street higher, gold hits fresh record

Tech stocks lead Wall Street higher, gold hits fresh record

-

Telefonica to shed around 5,500 jobs in Spain

-

Cambodia says Thailand launches air strikes after ASEAN meet on border clashes

Cambodia says Thailand launches air strikes after ASEAN meet on border clashes

-

McCullum wants to stay as England coach despite Ashes drubbing

-

EU slams China dairy duties as 'unjustified'

EU slams China dairy duties as 'unjustified'

-

Italy fines Apple nearly 100 mn euros over app privacy feature

-

America's Cup switches to two-year cycle

America's Cup switches to two-year cycle

-

Jesus could start for Arsenal in League Cup, says Arteta

-

EU to probe Czech aid for two nuclear units

EU to probe Czech aid for two nuclear units

-

Strauss says sacking Stokes and McCullum will not solve England's Ashes woes

Global stocks mostly fall on latest troubling inflation figures

Stock markets mostly retreated Thursday as fresh evidence of runaway global inflation ramped up expectations of more aggressive interest rate hikes by central banks, while disappointing earnings revived recession fears.

A day after data showing the biggest jump in US consumer prices in more than four decades, the Labor Department reported that US wholesale prices rose 1.1 percent, topping expectations, on a 10 percent surge in energy prices, more than double the increase in May.

Market watchers are now wondering whether the Federal Reserve could hike US borrowing costs by a full percentage point at a scheduled policy meeting this month.

Meanwhile, results from JPMorgan Chase lagged estimates as the banking giant reported a 28 percent drop in quarterly earnings and set aside additional funds in case of bad loans.

The disappointing results from JPMorgan and from Morgan Stanley underscore "that now we're entering the process of the very real possibility of an earnings recession," said Adam Sarhan of 50 Park Investments, referring to the possibility of two consecutive quarters of lower profits compared to the same three months of the prior year.

"That could lead to lower (stock) prices," Sarhan said. "Because first things slowed down on Main Street, and then you see earnings slow down on Wall Street."

The Dow and S&P 500 each finished with modest losses after starting the day sharply lower, staging a rebound as investors grabbed a bargain-hunting opportunity.

Also Thursday, the European Commission slashed its growth forecast for the region in light of the Ukraine invasion and the risks to the region's energy supply, and said eurozone inflation will end the year at 7.6 percent, much higher than previously estimated.

The forecasts "depend heavily on the evolution of the war and in particular its implications for Europe's gas supply," the commission said. "Further increases in gas prices could further raise inflation and stifle growth."

Europe's main stock indices finished more than one percent lower, with Milan slumping more than three percent amid political turmoil in Italy.

Italy's teetering government was thrown a lifeline late Thursday after the country's president refused to accept the resignation of Prime Minister Mario Draghi.

The crisis comes as Italy battles raging inflation and races to push through key reforms required by the European Union in exchange for post-pandemic funds.

Elsewhere, the euro fell back below parity with the US dollar once again shortly after US markets opened, before bouncing back.

- Key figures at around 2050 GMT -

New York - Dow: DOWN 0.5 percent at 30,630.17 (close)

New York - S&P 500: DOWN 0.3 percent at 3,790.38 (close)

New York - Nasdaq: UP less than 0.1 percent at 11,251.19 (close)

London - FTSE 100: DOWN 1.6 percent at 7,039.81 (close)

Frankfurt - DAX: DOWN 1.9 percent at 12,519.66 (close)

Paris - CAC 40: DOWN 1.4 percent at 5,915.41 (close)

EURO STOXX 50: DOWN 1.7 percent at 3,396.61 (close)

Tokyo - Nikkei 225: UP 0.6 percent at 26,643.39 (close)

Hong Kong - Hang Seng Index: DOWN 0.2 percent at 20,751.21 (close)

Shanghai - Composite: DOWN 0.1 percent at 3,281.74 (close)

Euro/dollar: DOWN at $1.0022 from $1.0059 Wednesday

Pound/dollar: DOWN at $1.1826 from $1.1889

Euro/pound: UP at 84.72 pence from 84.61 pence

Dollar/yen: UP at 138.93 yen from 138.20 yen

West Texas Intermediate: DOWN 0.5 percent at $95.78 per barrel

Brent North Sea crude: DOWN 0.5 percent at $99.10 per barrel

burs-jmb

R.Lee--AT