-

Olympic big air champion Su survives scare

Olympic big air champion Su survives scare

-

89 kidnapped Nigerian Christians released

-

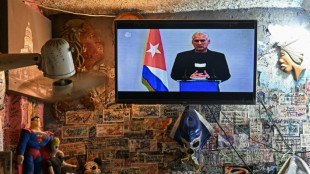

Cuba willing to talk to US, 'without pressure'

Cuba willing to talk to US, 'without pressure'

-

Famine spreading in Sudan's Darfur, UN-backed experts warn

-

2026 Winter Olympics flame arrives in Milan

2026 Winter Olympics flame arrives in Milan

-

Congo-Brazzaville's veteran president declares re-election run

-

Olympic snowboard star Chloe Kim proud to represent 'diverse' USA

Olympic snowboard star Chloe Kim proud to represent 'diverse' USA

-

Iran filmmaker Panahi fears Iranians' interests will be 'sacrificed' in US talks

-

Leicester at risk of relegation after six-point deduction

Leicester at risk of relegation after six-point deduction

-

Deadly storm sparks floods in Spain, raises calls to postpone Portugal vote

-

Trump urges new nuclear treaty after Russia agreement ends

Trump urges new nuclear treaty after Russia agreement ends

-

'Burned in their houses': Nigerians recount horror of massacre

-

Carney scraps Canada EV sales mandate, affirms auto sector's future is electric

Carney scraps Canada EV sales mandate, affirms auto sector's future is electric

-

Emotional reunions, dashed hopes as Ukraine soldiers released

-

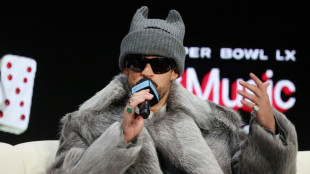

Bad Bunny promises to bring Puerto Rican culture to Super Bowl

Bad Bunny promises to bring Puerto Rican culture to Super Bowl

-

Venezuela amnesty bill excludes gross rights abuses under Chavez, Maduro

-

Lower pollution during Covid boosted methane: study

Lower pollution during Covid boosted methane: study

-

Doping chiefs vow to look into Olympic ski jumping 'penis injection' claims

-

England's Feyi-Waboso in injury scare ahead of Six Nations opener

England's Feyi-Waboso in injury scare ahead of Six Nations opener

-

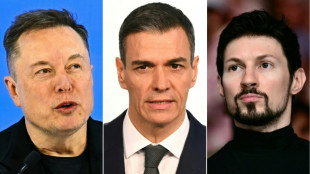

EU defends Spain after Telegram founder criticism

-

Novo Nordisk vows legal action to protect Wegovy pill

Novo Nordisk vows legal action to protect Wegovy pill

-

Swiss rivalry is fun -- until Games start, says Odermatt

-

Canadian snowboarder McMorris eyes slopestyle after crash at Olympics

Canadian snowboarder McMorris eyes slopestyle after crash at Olympics

-

Deadly storm sparks floods in Spain, disrupts Portugal vote

-

Ukrainian flag bearer proud to show his country is still standing

Ukrainian flag bearer proud to show his country is still standing

-

Carney scraps Canada EV sales mandate

-

Morocco says evacuated 140,000 people due to severe weather

Morocco says evacuated 140,000 people due to severe weather

-

Spurs boss Frank says Romero outburst 'dealt with internally'

-

Giannis suitors make deals as NBA trade deadline nears

Giannis suitors make deals as NBA trade deadline nears

-

Carrick stresses significance of Munich air disaster to Man Utd history

-

Record January window for transfers despite drop in spending

Record January window for transfers despite drop in spending

-

'Burned inside their houses': Nigerians recount horror of massacre

-

Iran, US prepare for Oman talks after deadly protest crackdown

Iran, US prepare for Oman talks after deadly protest crackdown

-

Winter Olympics opening ceremony nears as virus disrupts ice hockey

-

Mining giant Rio Tinto abandons Glencore merger bid

Mining giant Rio Tinto abandons Glencore merger bid

-

Davos forum opens probe into CEO Brende's Epstein links

-

ECB warns of stronger euro impact, holds rates

ECB warns of stronger euro impact, holds rates

-

Famine spreading in Sudan's Darfur, warn UN-backed experts

-

Lights back on in eastern Cuba after widespread blackout

Lights back on in eastern Cuba after widespread blackout

-

Russia, US agree to resume military contacts at Ukraine talks

-

Greece aims to cut queues at ancient sites with new portal

Greece aims to cut queues at ancient sites with new portal

-

No time frame to get Palmer in 'perfect' shape - Rosenior

-

Stocks fall as tech valuation fears stoke volatility

Stocks fall as tech valuation fears stoke volatility

-

US Olympic body backs LA28 leadership amid Wasserman scandal

-

Gnabry extends Bayern Munich deal until 2028

Gnabry extends Bayern Munich deal until 2028

-

England captain Stokes suffers facial injury after being hit by ball

-

Italy captain Lamaro amongst trio set for 50th caps against Scotland

Italy captain Lamaro amongst trio set for 50th caps against Scotland

-

Piastri plays down McLaren rivalry with champion Norris

-

ECB holds interest rates as strong euro causes jitters

ECB holds interest rates as strong euro causes jitters

-

Spain, Portugal face floods and chaos after deadly new storm

Gold, stocks slide on economic jitters

Gold prices sank further Wednesday and major stock markets mostly fell on fresh economic jitters caused by China-US trade uncertainty and a batch of weak company earnings.

Most European equity indices were lower and Wall Street fell slightly at the US open after declines in most Asian markets earlier.

London's benchmark FTSE 100 index was a rare climber as the pound dropped on lower-than-expected UK inflation data that signalled another potential interest-rate cut from the Bank of England this year.

Gold was once again a major focus after plunging six percent on Tuesday, a sell-off from record highs that rattled investor confidence in what is traditionally a safe-haven asset.

Traders are "desperately trying to gauge whether... (Tuesday's) historical collapse was indicative of a new period of weakness or simply a case of blowing off steam after a dramatic surge into record highs", said Joshua Mahony, chief market analyst at Scope Markets.

Gold fell to around $4,080 an ounce Wednesday after chalking up a record peak above $4,381 on Monday.

The retreat hit the share prices of gold miners, while individual companies were impacted by earnings updates.

In Paris, L'Oreal shed 6.2 percent after the cosmetics giant posted third-quarter earnings that undershot analysts expectations, with US tariffs imposed by President Donald Trump weighing on American sales in particular.

On the upside, Barclays and UniCredit posted positive results, easing fears of a new banking crisis emerging in the United States.

There were also concerns regarding US-China trade relations after Trump said a meeting with his counterpart Xi Jinping might not occur.

Trump said Tuesday that he expected to seal a "good" trade deal with Xi at the APEC summit in South Korea next week, adding that "I think we're going to have a very successful meeting. Certainly, there are a lot of people that are waiting for it."

But he then added: "Maybe it won't happen. Things can happen where, for instance, maybe somebody will say, 'I don't want to meet. It's too nasty.' But it's really not nasty."

Oil prices rallied on speculation that India would agree to cut its purchases of the commodity from Russia as part of a trade deal with the United States.

Trump has claimed New Delhi pledged to reduce its imports from Russia, which Washington says helps finance Moscow's war in Ukraine.

Indian officials have neither confirmed nor denied any policy shift.

- Key figures at around 1340 GMT -

New York - Dow: DOWN 0.1 percent at 46,858.74 points

New York - S&P 500: DOWN 0.1 percent at 6,728.63

New York - Nasdaq: DOWN 0.3 percent at 22,891.26

London - FTSE 100: UP 1.0 percent at 9,516.53

Paris - CAC 40: DOWN 0.4 percent at 8,224.91

Frankfurt - DAX: DOWN 0.4 percent at 24,244.21

Tokyo - Nikkei 225: FLAT at 49,307.79 (close)

Hong Kong - Hang Seng Index: DOWN 0.9 percent at 25,781.77 (close)

Shanghai - Composite: DOWN 0.1 percent at 3,913.76 (close)

Euro/dollar: DOWN at $1.1594 from $1.1606 on Tuesday

Pound/dollar: DOWN at $1.3340 from $1.3374

Dollar/yen: FLAT at 151.92 yen

Euro/pound: UP at 86.94 pence from 86.78 pence

Brent North Sea Crude: UP 2.0 percent at $62.53 per barrel

West Texas Intermediate: UP 2.2 percent at $58.49 per barrel

E.Rodriguez--AT