-

Delayed US data expected to show solid growth in 3rd quarter

Delayed US data expected to show solid growth in 3rd quarter

-

Thunder bounce back to down Grizzlies, Nuggets sink Jazz

-

Amazon says blocked 1,800 North Koreans from applying for jobs

Amazon says blocked 1,800 North Koreans from applying for jobs

-

Trump says US needs Greenland 'for national security'

-

Purdy first 49er since Montana to throw five TDs as Colts beaten

Purdy first 49er since Montana to throw five TDs as Colts beaten

-

Australia captain Cummins out of rest of Ashes, Lyon to have surgery

-

North Korea's Kim tours hot tubs, BBQ joints at lavish new mountain resort

North Korea's Kim tours hot tubs, BBQ joints at lavish new mountain resort

-

Asian markets rally again as rate cut hopes bring Christmas cheer

-

Australian state poised to approve sweeping new gun laws, protest ban

Australian state poised to approve sweeping new gun laws, protest ban

-

Trapped under Israeli bombardment, Gazans fear the 'new border'

-

Families want answers a year after South Korea's deadliest plane crash

Families want answers a year after South Korea's deadliest plane crash

-

Myanmar's long march of military rule

-

Disputed Myanmar election wins China's vote of confidence

Disputed Myanmar election wins China's vote of confidence

-

Myanmar junta stages election after five years of civil war

-

Ozempic Meals? Restaurants shrink portions to match bite-sized hunger

Ozempic Meals? Restaurants shrink portions to match bite-sized hunger

-

'Help me, I'm dying': inside Ecuador's TB-ridden gang-plagued prisons

-

Australia's Cummins, Lyon out of fourth Ashes Test

Australia's Cummins, Lyon out of fourth Ashes Test

-

US singer Barry Manilow reveals lung cancer diagnosis

-

'Call of Duty' co-creator Vince Zampella killed in car crash

'Call of Duty' co-creator Vince Zampella killed in car crash

-

Decentralized Masters Announced as the Best Crypto Course of 2025 (Courses on Cryptocurrency Ranked)

-

Trump says would be 'smart' for Venezuela's Maduro to step down

Trump says would be 'smart' for Venezuela's Maduro to step down

-

Steelers' Metcalf suspended two games over fan outburst

-

Salah, Foster take Egypt and South Africa to AFCON Group B summit

Salah, Foster take Egypt and South Africa to AFCON Group B summit

-

Napoli beat Bologna to lift Italian Super Cup

-

Salah snatches added-time winner for Egypt after Zimbabwe scare

Salah snatches added-time winner for Egypt after Zimbabwe scare

-

Penalty king Jimenez strikes for Fulham to sink Forest

-

Kansas City Chiefs confirm stadium move

Kansas City Chiefs confirm stadium move

-

Liverpool rocked by Isak blow after surgery on broken leg

-

Liverpool rocked by Isak blow after surgery on ankle injury

Liverpool rocked by Isak blow after surgery on ankle injury

-

US stocks push higher while gold, silver notch fresh records

-

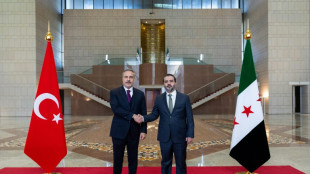

Deadly clashes in Aleppo as Turkey urges Kurds not to be obstacle to Syria's stability

Deadly clashes in Aleppo as Turkey urges Kurds not to be obstacle to Syria's stability

-

Is the United States after Venezuela's oil?

-

Trump admin halts US offshore wind projects citing 'national security'

Trump admin halts US offshore wind projects citing 'national security'

-

Right wing urges boycott of iconic Brazilian flip-flops

-

From misfits to MAGA: Nicki Minaj's political whiplash

From misfits to MAGA: Nicki Minaj's political whiplash

-

Foster grabs South Africa winner against Angola in AFCON

-

Russia pledges 'full support' for Venezuela against US 'hostilities'

Russia pledges 'full support' for Venezuela against US 'hostilities'

-

Spotify says piracy activists hacked its music catalogue

-

Winter Olympics organisers resolve snow problem at ski site

Winter Olympics organisers resolve snow problem at ski site

-

Fuming Denmark summons US ambassador over Greenland envoy

-

UK's street artist Banksy unveils latest mural in London

UK's street artist Banksy unveils latest mural in London

-

Rugby players lose order challenge in brain injury claim

-

UK singer Chris Rea dies at 74, days before Christmas

UK singer Chris Rea dies at 74, days before Christmas

-

Last of kidnapped Nigerian pupils handed over, government says

-

Zambia strike late to hold Mali in AFCON opener

Zambia strike late to hold Mali in AFCON opener

-

Outcry follows CBS pulling program on prison key to Trump deportations

-

Sri Lanka cyclone caused $4.1 bn damage: World Bank

Sri Lanka cyclone caused $4.1 bn damage: World Bank

-

Billionaire Ellison offers personal guarantee for son's bid for Warner Bros

-

Tech stocks lead Wall Street higher, gold hits fresh record

Tech stocks lead Wall Street higher, gold hits fresh record

-

Telefonica to shed around 5,500 jobs in Spain

European stocks fall before key US inflation data

European equities fell Wednesday with traders on edge before key June inflation data in the United States.

The London stock market sank by nearly one percent, around half-way through the session, despite news of rebounding UK economic growth in May.

Eurozone stocks were down by about one percent after a mixed close in Asia.

The euro clawed back slightly, one day after hitting dollar parity for the first time in two decades on concerns about a possible recession in the eurozone.

Oil rebounded slightly having fallen sharply Tuesday on weaker demand expectations.

- Tenterhooks -

"Markets are on tenterhooks ahead of the US inflation data which will hold great sway over the Fed's rate-hike plans," said Exinity Markets analyst Han Tan.

"A fresh four-decade high, along with more signs of unabating inflationary pressures, may well force the Fed to punch harder and faster in its battle against runaway consumer prices."

Markets fear more evidence of red hot US inflation will prompt the Fed to keep hiking interest rates aggressively after it ramped up borrowing costs by three-quarters of a percentage point last month.

US inflation had spiked to a four-decade high of 8.6 percent in May.

Inflation is soaring worldwide after economies reopened from pandemic lockdowns and as the Ukraine war keeps energy prices elevated.

In a further sign of the pressure being felt around the world, the New Zealand and South Korean central banks each lifted interest rates by 0.5 percentage points Wednesday.

It was the steepest increase by Seoul since 1999.

- Europe gas crisis -

The euro held above $1 a day after hitting parity for the first time since late 2002, as a worsening energy crisis fanned expectations that the eurozone would plunge into recession.

With Russian energy giant Gazprom starting 10 days of maintenance Monday on its Nord Stream 1 pipeline, the bloc -- and particularly gas-reliant Germany -- is waiting nervously to see if the taps are turned back on.

The single currency has been hit also by the European Central Bank's reluctance to raise rates -- in contrast to monetary policy elsewhere.

"A prolonged cut to the gas supply would halt a lot of economic activity, sending (Germany) deep into recession," said Tapas Strickland at National Australia Bank.

He said July 21 -- when the gas should be switched back on -- will be a crucial date.

"That date also happens to be the day of the next ECB meeting," Strickland added.

"Either of these events are key risk events. Russia playing gas politics by not switching on the gas supply would likely see the euro lurch much lower."

- Key figures at around 1130 GMT -

London - FTSE 100: DOWN 0.8 percent at 7,149.84 points

Frankfurt - DAX: DOWN 1.0 percent at 12,770.74

Paris - CAC 40: DOWN 0.9 percent at 5,989.00

EURO STOXX 50: DOWN 1.0 percent at 3,451.61

Tokyo - Nikkei 225: UP 0.5 percent at 26,478.77 (close)

Hong Kong - Hang Seng Index: DOWN 0.2 percent at 20,797.95 (close)

Shanghai - Composite: UP 0.1 percent at 3,284.29 (close)

New York - Dow: DOWN 0.6 percent at 30,981.33 (close)

Euro/dollar: UP at $1.0055 from $1.0037 Tuesday

Pound/dollar: UP at $1.1919 from $1.1889

Euro/pound: DOWN at 84.37 pence from 84.40 pence

Dollar/yen: UP at 137.08 yen from 136.84 yen

West Texas Intermediate: UP 1.0 percent at $96.84 per barrel

Brent North Sea crude: UP 0.6 percent at $100.05 per barrel

T.Wright--AT