-

Cambodia asks Thailand to move border talks to Malaysia

Cambodia asks Thailand to move border talks to Malaysia

-

In Bulgaria, villagers fret about euro introduction

-

Key to probe England's 'stag-do' drinking on Ashes beach break

Key to probe England's 'stag-do' drinking on Ashes beach break

-

Delayed US data expected to show solid growth in 3rd quarter

-

Thunder bounce back to down Grizzlies, Nuggets sink Jazz

Thunder bounce back to down Grizzlies, Nuggets sink Jazz

-

Amazon says blocked 1,800 North Koreans from applying for jobs

-

Trump says US needs Greenland 'for national security'

Trump says US needs Greenland 'for national security'

-

Purdy first 49er since Montana to throw five TDs as Colts beaten

-

Australia captain Cummins out of rest of Ashes, Lyon to have surgery

Australia captain Cummins out of rest of Ashes, Lyon to have surgery

-

North Korea's Kim tours hot tubs, BBQ joints at lavish new mountain resort

-

Asian markets rally again as rate cut hopes bring Christmas cheer

Asian markets rally again as rate cut hopes bring Christmas cheer

-

Australian state poised to approve sweeping new gun laws, protest ban

-

Trapped under Israeli bombardment, Gazans fear the 'new border'

Trapped under Israeli bombardment, Gazans fear the 'new border'

-

Families want answers a year after South Korea's deadliest plane crash

-

Myanmar's long march of military rule

Myanmar's long march of military rule

-

Disputed Myanmar election wins China's vote of confidence

-

Myanmar junta stages election after five years of civil war

Myanmar junta stages election after five years of civil war

-

Ozempic Meals? Restaurants shrink portions to match bite-sized hunger

-

'Help me, I'm dying': inside Ecuador's TB-ridden gang-plagued prisons

'Help me, I'm dying': inside Ecuador's TB-ridden gang-plagued prisons

-

Australia's Cummins, Lyon out of fourth Ashes Test

-

US singer Barry Manilow reveals lung cancer diagnosis

US singer Barry Manilow reveals lung cancer diagnosis

-

'Call of Duty' co-creator Vince Zampella killed in car crash

-

Karviva Announces Launch of Energy and ACE Collagen Juices at Gelson's Stores This December

Karviva Announces Launch of Energy and ACE Collagen Juices at Gelson's Stores This December

-

MindMaze Therapeutics: Consolidating a Global Approach to Reimbursement for Next-Generation Therapeutics

-

Decentralized Masters Announced as the Best Crypto Course of 2025 (Courses on Cryptocurrency Ranked)

Decentralized Masters Announced as the Best Crypto Course of 2025 (Courses on Cryptocurrency Ranked)

-

Trump says would be 'smart' for Venezuela's Maduro to step down

-

Steelers' Metcalf suspended two games over fan outburst

Steelers' Metcalf suspended two games over fan outburst

-

Salah, Foster take Egypt and South Africa to AFCON Group B summit

-

Napoli beat Bologna to lift Italian Super Cup

Napoli beat Bologna to lift Italian Super Cup

-

Salah snatches added-time winner for Egypt after Zimbabwe scare

-

Penalty king Jimenez strikes for Fulham to sink Forest

Penalty king Jimenez strikes for Fulham to sink Forest

-

Kansas City Chiefs confirm stadium move

-

Liverpool rocked by Isak blow after surgery on broken leg

Liverpool rocked by Isak blow after surgery on broken leg

-

Liverpool rocked by Isak blow after surgery on ankle injury

-

US stocks push higher while gold, silver notch fresh records

US stocks push higher while gold, silver notch fresh records

-

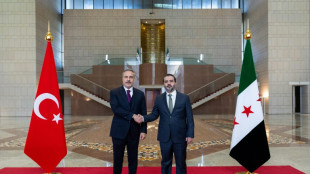

Deadly clashes in Aleppo as Turkey urges Kurds not to be obstacle to Syria's stability

-

Is the United States after Venezuela's oil?

Is the United States after Venezuela's oil?

-

Trump admin halts US offshore wind projects citing 'national security'

-

Right wing urges boycott of iconic Brazilian flip-flops

Right wing urges boycott of iconic Brazilian flip-flops

-

From misfits to MAGA: Nicki Minaj's political whiplash

-

Foster grabs South Africa winner against Angola in AFCON

Foster grabs South Africa winner against Angola in AFCON

-

Russia pledges 'full support' for Venezuela against US 'hostilities'

-

Spotify says piracy activists hacked its music catalogue

Spotify says piracy activists hacked its music catalogue

-

Winter Olympics organisers resolve snow problem at ski site

-

Fuming Denmark summons US ambassador over Greenland envoy

Fuming Denmark summons US ambassador over Greenland envoy

-

UK's street artist Banksy unveils latest mural in London

-

Rugby players lose order challenge in brain injury claim

Rugby players lose order challenge in brain injury claim

-

UK singer Chris Rea dies at 74, days before Christmas

-

Last of kidnapped Nigerian pupils handed over, government says

Last of kidnapped Nigerian pupils handed over, government says

-

Zambia strike late to hold Mali in AFCON opener

China lockdown worries hit Asian equities, crude prices

Asian markets and oil prices fell Monday with a fresh Covid flare-up in Shanghai fanning fears of another economically painful lockdown in China's biggest city.

The news came after a forecast-busting US jobs report last week indicated the world's top economy was coping so far with the Federal Reserve interest rate hikes, giving it room for more as it battles soaring inflation.

Traders are also keeping tabs on developments in Washington as President Joe Biden weighs removing some of the Donald Trump-era tariffs on Chinese goods worth hundreds of billions of dollars.

Shanghai recorded more than 120 virus cases at the weekend, having seen its first case of the highly contagious BA.5 Omicron strain, forcing officials to launch another mass testing drive.

With China fixated on its zero-Covid strategy of wiping out the disease, there is increasing concern that authorities will revert to another painful lockdown, with Shanghai residents having only emerged from a two-month confinement in June.

There have also been new infections uncovered in other parts of the country, including Beijing.

Data this week will provide a fresh update on the economic impact of those measures, as well as similar strict controls in Beijing.

The prospect of another lockdown sparked a sell-off in Hong Kong and Shanghai, with Chinese tech firms also taking a battering after authorities fined giant Tencent and Alibaba over not properly reporting past deals.

Hong Kong-listed casino operators were also sharply lower after officials in Macau embarked on a week-long lockdown to curb its worst coronavirus outbreak.

There were also losses in Sydney, Seoul, Taipei, Manila, Mumbai, Jakarta and Wellington.

However, there Tokyo rose as traders welcomed Japan's ruling bloc securing a strong win in Sunday's upper house election, held days after the assassination of former premier Shinzo Abe.

The result should provide the government with some stability, while there were also hopes for a cabinet reshuffle and economic stimulus.

London, Paris and Frankfurt were all sharply lower in the morning.

- Fed 'must be resolute' -

The weak start to the week followed a tepid lead from Wall Street, where the strong jobs reading ramped up bets on further big Fed rate hikes after officials said the economy was strong enough to withstand them.

"The resilience of the US labour market, with the unemployment rate at 3.6 percent, as well as jobs markets elsewhere, helps to offer a compelling narrative to those who think recession concerns are overblown," said CMC Markets analyst Michael Hewson.

The central bank is predicted to announce a second successive 0.75 percentage point lift at its next meeting this month, while further big increases are also expected before the end of the year.

Policymakers have said they are determined to bring inflation down from four-decade highs, even if that means hurting growth.

On Friday, New York Fed president John Williams reiterated its determination, saying in a speech: "Inflation is sky-high, and it is the number one danger to the overall health and stability of a well-functioning economy.

"I want to be clear: this is not an easy task. We must be resolute, and we cannot fall short."

Worries about another shock to the Chinese economy from possible shutdowns also dented oil markets as concerns about a hit to demand outweighed ongoing concerns about tight supplies.

Still, there is a view that prices will remain elevated for now.

"Covid numbers are ticking up again," said SPI Asset Management's Stephen Innes.

"Although the possible demand impact of a recession continues to weigh on sentiment, the prevailing view, at least for now, is that the longer-term structural issues facing the oil market will support prices."

Investors will be keeping watch on Biden's visit this week to Saudi Arabia, where he is expected to push for the crude giant to ramp up production to make up for the output lost to sanctions against Russia.

- Key figures at around 0810 GMT -

Tokyo - Nikkei 225: UP 1.1 percent at 26,812.80 (close)

Hong Kong - Hang Seng Index: DOWN 2.8 percent at 21,124.20 (close)

Shanghai - Composite: DOWN 1.3 percent at 3,313.58 (close)

London - FTSE 100: DOWN 1.2 percent at 7,113.73

West Texas Intermediate: DOWN 1.9 percent at $102.79 per barrel

Brent North Sea crude: DOWN 1.7 percent at $105.33 per barrel

Euro/dollar: DOWN at 1.0123 from 1.0183 on Friday

Pound/dollar: DOWN at 1.1967 from 1.2034

Euro/pound: UP at 84.60 pence from 84.59 pence

Dollar/yen: UP at 136.80 yen from 136.10 yen

New York - Dow: DOWN 0.2 percent at 31,338.15

E.Flores--AT