-

Liverpool's Isak faces two months out after 'reckless' tackle: Slot

Liverpool's Isak faces two months out after 'reckless' tackle: Slot

-

Thailand-Cambodia border meeting in doubt over venue row

-

For director Josh Safdie, 'Marty Supreme' and Timothee Chalamet are one and the same

For director Josh Safdie, 'Marty Supreme' and Timothee Chalamet are one and the same

-

Kyiv's wartime Christmas showcases city's 'split' reality

-

Gazans fear renewed displacement after Israeli strikes

Gazans fear renewed displacement after Israeli strikes

-

Locals sound alarm as Bijagos Islands slowly swallowed by sea

-

Markets mostly rise as rate cut hopes bring Christmas cheer

Markets mostly rise as rate cut hopes bring Christmas cheer

-

Cambodia asks Thailand to move border talks to Malaysia

-

In Bulgaria, villagers fret about euro introduction

In Bulgaria, villagers fret about euro introduction

-

Key to probe England's 'stag-do' drinking on Ashes beach break

-

Delayed US data expected to show solid growth in 3rd quarter

Delayed US data expected to show solid growth in 3rd quarter

-

Thunder bounce back to down Grizzlies, Nuggets sink Jazz

-

Amazon says blocked 1,800 North Koreans from applying for jobs

Amazon says blocked 1,800 North Koreans from applying for jobs

-

Trump says US needs Greenland 'for national security'

-

Purdy first 49er since Montana to throw five TDs as Colts beaten

Purdy first 49er since Montana to throw five TDs as Colts beaten

-

Australia captain Cummins out of rest of Ashes, Lyon to have surgery

-

North Korea's Kim tours hot tubs, BBQ joints at lavish new mountain resort

North Korea's Kim tours hot tubs, BBQ joints at lavish new mountain resort

-

Asian markets rally again as rate cut hopes bring Christmas cheer

-

Australian state poised to approve sweeping new gun laws, protest ban

Australian state poised to approve sweeping new gun laws, protest ban

-

Trapped under Israeli bombardment, Gazans fear the 'new border'

-

Families want answers a year after South Korea's deadliest plane crash

Families want answers a year after South Korea's deadliest plane crash

-

Myanmar's long march of military rule

-

Disputed Myanmar election wins China's vote of confidence

Disputed Myanmar election wins China's vote of confidence

-

Myanmar junta stages election after five years of civil war

-

Ozempic Meals? Restaurants shrink portions to match bite-sized hunger

Ozempic Meals? Restaurants shrink portions to match bite-sized hunger

-

'Help me, I'm dying': inside Ecuador's TB-ridden gang-plagued prisons

-

Australia's Cummins, Lyon out of fourth Ashes Test

Australia's Cummins, Lyon out of fourth Ashes Test

-

US singer Barry Manilow reveals lung cancer diagnosis

-

'Call of Duty' co-creator Vince Zampella killed in car crash

'Call of Duty' co-creator Vince Zampella killed in car crash

-

Zenwork Joins CERCA to Support IRS Modernization and Strengthen National Information Reporting Infrastructure

-

Cellbxhealth PLC Announces Holding(s) in Company

Cellbxhealth PLC Announces Holding(s) in Company

-

Top Gold IRA Companies 2026 Ranked (Augusta Precious Metals, Lear Capital and More Reviewed)

-

Karviva Announces Launch of Energy and ACE Collagen Juices at Gelson's Stores This December

Karviva Announces Launch of Energy and ACE Collagen Juices at Gelson's Stores This December

-

MindMaze Therapeutics: Consolidating a Global Approach to Reimbursement for Next-Generation Therapeutics

-

Decentralized Masters Announced as the Best Crypto Course of 2025 (Courses on Cryptocurrency Ranked)

Decentralized Masters Announced as the Best Crypto Course of 2025 (Courses on Cryptocurrency Ranked)

-

Trump says would be 'smart' for Venezuela's Maduro to step down

-

Steelers' Metcalf suspended two games over fan outburst

Steelers' Metcalf suspended two games over fan outburst

-

Salah, Foster take Egypt and South Africa to AFCON Group B summit

-

Napoli beat Bologna to lift Italian Super Cup

Napoli beat Bologna to lift Italian Super Cup

-

Salah snatches added-time winner for Egypt after Zimbabwe scare

-

Penalty king Jimenez strikes for Fulham to sink Forest

Penalty king Jimenez strikes for Fulham to sink Forest

-

Kansas City Chiefs confirm stadium move

-

Liverpool rocked by Isak blow after surgery on broken leg

Liverpool rocked by Isak blow after surgery on broken leg

-

Liverpool rocked by Isak blow after surgery on ankle injury

-

US stocks push higher while gold, silver notch fresh records

US stocks push higher while gold, silver notch fresh records

-

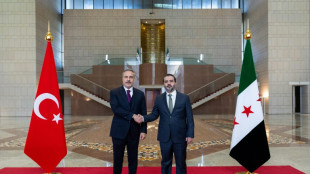

Deadly clashes in Aleppo as Turkey urges Kurds not to be obstacle to Syria's stability

-

Is the United States after Venezuela's oil?

Is the United States after Venezuela's oil?

-

Trump admin halts US offshore wind projects citing 'national security'

-

Right wing urges boycott of iconic Brazilian flip-flops

Right wing urges boycott of iconic Brazilian flip-flops

-

From misfits to MAGA: Nicki Minaj's political whiplash

Oil rises after sell-off but euro stuck at 20-year low, equities drop

Oil prices rose Wednesday after suffering a painful drop the previous day, though the euro remained wedged at a 20-year low and equities mostly fell in Asia as recession fears continue to flow through trading floors.

Both main crude contracts were pummelled Tuesday as investors grow increasingly worried that leading economies will contract this year or next owing to sharp central bank interest rate hikes aimed at fighting decades-high inflation.

The main US contract WTI sank nearly nine percent below $100 a barrel for the first time since April, while Brent shed around 10 percent on expectations that any recession will slam demand, despite tight supplies caused by the Ukraine war.

And Citigroup said in a note that a recession could lead prices to as low as $65 this year if OPEC and other major producers do not step in to provide support and companies do not invest.

There are also signs that the high cost of fuel is hurting demand, in turn pushing prices down. Earlier this week, the head of Asia at crude trading giant Vitol said he saw signs consumers were beginning to feel the pressure of high prices -- a phenomenon known as demand destruction.

Still, Goldman Sachs said it thought the commodity would remain elevated.

"While the odds of a recession are indeed rising, it is premature for the oil market to be succumbing to such concerns," the bank's analysts including Damien Courvalin said in a note.

"The global economy is still growing, with the rise in oil demand this year set to significantly outperform GDP growth."

- Euro-dollar parity eyed -

Commentators said falling oil prices and the prospect of a recession could give central banks room to ease up on their monetary tightening campaigns, which could provide some relief to equities.

Among those to benefit are rate-sensitive tech firms, which have risen as Treasury yields, a proxy for interest rates, fall.

"Markets are saying recession is coming, inflation will slow down, commodities will fall and the Fed will cut rates in 2023," said Gang Hu, at Winshore Capital Partners.

He said it was hard to go against the view "because this storyline is consistent. It can be a self-fulfilling process".

However, while there was help from speculation that Joe Biden was considering removing some Trump-era tariffs on Chinese goods, equities struggled in Asia.

Tokyo, Hong Kong, Shanghai, Sydney, Seoul, Jakarta and Taipei were all down, though Singapore, Wellington and Manila saw gains.

Investors have also been spooked by a fresh coronavirus outbreak in parts of China that has seen some cities locked down as part of officials' zero-Covid policy.

The euro remained under pressure and appeared to be heading towards parity with the dollar after hitting a 20-year low owing to the European Central Bank's decision not to lift interest rates until this month, lagging the Fed's fast pace of hikes that have sent the dollar soaring.

The continent also faces an energy crisis caused by sanctions on Russian fuel, while a strike by workers in Norway threatened to hit supplies further.

"The euro has depreciated sharply due to a toxic cocktail of negative drivers," said SPI Asset Management's Stephen Innes.

"An oddly hesitant ECB contrasts with a more aggressive Fed, worries about natural gas supply disruption and economic recession are deepening."

And he warned further falls could be on the way for the single currency.

"We have unlikely reached maximum uncertainty and total negativity, which opens the door to a test below sub-parity. So with the euro-dollar in the mid-1.02s, it might not be too late to punch your ticket for a ride on the parity party bandwagon."

- Key figures at around 0230 GMT -

West Texas Intermediate: UP 0.8 percent at $100.27 per barrel

Brent North Sea crude: UP 1.3 percent at $104.07 per barrel

Euro/dollar: DOWN at $1.0262 from $1.0266 Tuesday

Euro/pound: DOWN at 85.78 pence from 85.85 pence

Dollar/yen: UP at 135.24 yen from 135.87 yen

Pound/dollar: UP at $1.1966 from $1.1956

Tokyo - Nikkei 225: DOWN 1.3 percent at 26,089.86 (break)

Hong Kong - Hang Seng Index: DOWN 1.1 percent at 21,609.59

Shanghai - Composite: DOWN 1.1 percent at 3,366.66

New York - Dow: DOWN 0.4 percent 30.967,82 (close)

London - FTSE 100: DOWN 2.9 percent at 7,025.47 (close)

A.Williams--AT