-

UK's Starmer scrambles to limit Epstein fallout as aides quit

UK's Starmer scrambles to limit Epstein fallout as aides quit

-

US skater Malinin 'full of confidence' after first Olympic gold

-

Sydney police pepper spray protesters during rallies against Israeli president's visit

Sydney police pepper spray protesters during rallies against Israeli president's visit

-

Tokyo stocks hit record high after Japanese premier wins vote

-

Israel says killed four militants exiting Gaza tunnel

Israel says killed four militants exiting Gaza tunnel

-

Franzoni sets pace in Olympic team combined

-

Captain's injury agony mars 'emotional' Italy debut at T20 World Cup

Captain's injury agony mars 'emotional' Italy debut at T20 World Cup

-

Family matters: Thaksin's party down, maybe not out

-

African players in Europe: Ouattara fires another winner for Bees

African players in Europe: Ouattara fires another winner for Bees

-

Pressure grows on UK's Starmer over Epstein fallout

-

Music world mourns Ghana's Ebo Taylor, founding father of highlife

Music world mourns Ghana's Ebo Taylor, founding father of highlife

-

HK mogul's ex-workers 'broke down in tears' as they watched sentencing

-

JD Vance set for Armenia, Azerbaijan trip

JD Vance set for Armenia, Azerbaijan trip

-

Sydney police deploy pepper spray as Israeli president's visit sparks protests

-

EU warns Meta it must open up WhatsApp to rival AI chatbots

EU warns Meta it must open up WhatsApp to rival AI chatbots

-

Scotland spoil Italy's T20 World Cup debut with big win

-

Stocks track Wall St rally as Tokyo hits record on Takaichi win

Stocks track Wall St rally as Tokyo hits record on Takaichi win

-

Israeli president says 'we will overcome evil' at Bondi Beach

-

Munsey leads Scotland to 207-4 against Italy at T20 World Cup

Munsey leads Scotland to 207-4 against Italy at T20 World Cup

-

Venezuela's Machado says ally 'kidnapped' after his release

-

Japan restarts world's biggest nuclear plant again

Japan restarts world's biggest nuclear plant again

-

Bangladesh poll rivals rally on final day of campaign

-

Third impeachment case filed against Philippine VP Duterte

Third impeachment case filed against Philippine VP Duterte

-

Wallaby winger Nawaqanitawase heads to Japan

-

Thailand's Anutin rides wave of nationalism to election victory

Thailand's Anutin rides wave of nationalism to election victory

-

Venezuela's Machado says ally kidnapped by armed men after his release

-

Maye longs for do-over as record Super Bowl bid ends in misery

Maye longs for do-over as record Super Bowl bid ends in misery

-

Seahawks' Walker rushes to Super Bowl MVP honors

-

Darnold basks in 'special journey' to Super Bowl glory

Darnold basks in 'special journey' to Super Bowl glory

-

Japan's Takaichi may struggle to soothe voters and markets

-

Bad Bunny celebrates Puerto Rico at Super Bowl, angering Trump

Bad Bunny celebrates Puerto Rico at Super Bowl, angering Trump

-

Seahawks soar to Super Bowl win over Patriots

-

'Want to go home': Indonesian crew abandoned off Africa demand wages

'Want to go home': Indonesian crew abandoned off Africa demand wages

-

Asian stocks track Wall St rally as Tokyo hits record on Takaichi win

-

Hong Kong sentences pro-democracy mogul Jimmy Lai to 20 years in jail

Hong Kong sentences pro-democracy mogul Jimmy Lai to 20 years in jail

-

Bad Bunny celebrates Puerto Rico in joyous Super Bowl halftime show

-

Three prominent opposition figures released in Venezuela

Three prominent opposition figures released in Venezuela

-

Japan PM Takaichi basks in historic election triumph

-

Israeli president says 'we shall overcome this evil' at Bondi Beach

Israeli president says 'we shall overcome this evil' at Bondi Beach

-

'Flood' of disinformation ahead of Bangladesh election

-

Arguments to begin in key US social media addiction trial

Arguments to begin in key US social media addiction trial

-

Geophysics Converge Ahead of Colosseum Deeper Drill Program

-

Bonk, Inc. Reports January Net Revenue of $2.46 Million from BONK.fun Interest; Monthly Income Surges 68%

Bonk, Inc. Reports January Net Revenue of $2.46 Million from BONK.fun Interest; Monthly Income Surges 68%

-

American Resources Corporation's ReElement Technologies Announce Attendance at Key African Critical Mineral Conference

-

Black Book Research Releases 2026 India Digital Health & Acute Care EHR Market Report Highlighting ABDM-Driven Procurement Shift, Rapid Cloud Adoption, and a Coming HIS Replacement Wave

Black Book Research Releases 2026 India Digital Health & Acute Care EHR Market Report Highlighting ABDM-Driven Procurement Shift, Rapid Cloud Adoption, and a Coming HIS Replacement Wave

-

Sands & Associates Wins 2026 Consumer Choice Award for Licensed Insolvency Trustee in Vancouver, Surrey, Abbotsford, Kelowna and Victoria

-

Resolve Legal Group Receives Consumer Choice Award for Family Law in Southern Alberta

Resolve Legal Group Receives Consumer Choice Award for Family Law in Southern Alberta

-

Zakhary Rhinoplasty & Facial Plastic Surgery Clinic Wins Consumer Choice Award for Excellence in Cosmetic Procedures

-

Gemdale Gold Announces Approval for Listing on the TSX Venture Exchange

Gemdale Gold Announces Approval for Listing on the TSX Venture Exchange

-

Money Mentors Wins Consumer Choice Award for Credit & Debt Counselling Services in Northern Alberta

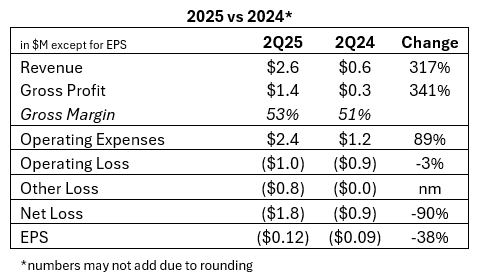

Laser Photonics Reports Q2 2025 Revenue Growth of 317% Year-Over-Year

Revenue Surges to $2.6 Million as Strategic Acquisitions and Multi-Sector Expansion Drive Accelerated Growth;

Implemented $2 Million in Annualized Cost Reductions During the Quarter

ORLANDO, FLORIDA / ACCESS Newswire / August 18, 2025 / Laser Photonics Corporation (NASDAQ:LASE), ("LPC"), $LASE, a leading global developer of CleanTech laser systems for laser cleaning and other material applications, today announced results for its second quarter ended June 30, 2025.

Q2 2025 Financial Highlights (versus Q2 2024):

Revenue increased 317% to $2.6 million compared to $0.6 million

Gross profit expanded 341% to $1.4 million with gross margins improving to 53.5%

Successfully implemented plan to reduce $2 million in annualized expenses during the quarter

Net loss included approximately $0.8 million in interest expense classified under "Other Income (Loss) compared to $0.

Wayne Tupuola, CEO of Laser Photonics, commented:

"Q2 demonstrated the accelerating momentum of our strategic transformation, with revenue growth exceeding 300% year-over-year for the second consecutive quarter. Our expanded capabilities through the CMS acquisition continue to resonate strongly with customers, evidenced by significant wins including a Fortune 500 appliance manufacturer and a premier global manufacturing services provider. The announced Beamer acquisition further strengthens our 'Made in America' positioning and creates a powerful distribution platform with coast-to-coast reach.

"Equally important, we delivered on our commitment to operational discipline by implementing $2 million in annualized cost reductions while maintaining our growth trajectory. Our gross margins expanded to 53.5%, demonstrating an improved product mix as we scale our diversified laser solutions portfolio. We believe these results validate our strategic vision and position us well for sustained profitable growth."

Carlos Sardinas, Chief Financial Officer of Laser Photonics, added:

"Our Q2 financial performance reflects the successful execution of our dual strategy of growth acceleration and operational efficiency. Additionally, this quarter's results included the incremental headcount from the CMS acquisition, which closed in Q4 last year. The $2 million in annualized cost reductions implemented during the quarter will provide full benefits in subsequent periods, positioning us for improved operating leverage as we integrate our recent and future acquisitions."

Business Highlights

Strategic Acquisitions & Integration: Building on the successful CMS acquisition completed in Q4 2024, Laser Photonics announced the strategic acquisition of Beamer Laser Marking Systems in June 2025. Beamer's historical performance of $3+ million in annual revenue (according to its prior owner) provides immediate revenue opportunities, while its established distribution network of 19 tech centers and 5 demonstration showrooms creates a powerful platform for cross-selling LPC's comprehensive laser solutions portfolio.

CMS Continued Success: Control Micro Systems secured significant orders from a Fortune 500 home appliance manufacturer and a premier global manufacturing services provider, highlighting the division's expertise in custom-engineered laser marking solutions. These wins demonstrate CMS's proven ability to deliver exceptional value to industry leaders across diverse sectors including precision manufacturing and high-reliability OEM markets.

CleanTech Industrial Expansion: Laser Photonics received an order for its CleanTech Industrial Roughening Laser 3040 (CTIR-3040) through W.W. Grainger for use by the Massachusetts Bay Transportation Authority (MBTA). This strategic win validates the technology's effectiveness in transportation infrastructure applications and strengthens LPC's relationship with Grainger's extensive distribution network serving 4.5 million customers worldwide.

Operational Excellence: The Company successfully implemented $2 million in annualized headcount reductions during Q2 2025, demonstrating disciplined cost management while maintaining growth momentum. These reductions help offset higher operating expenses from acquired companies, with full benefits expected to materialize in subsequent quarters.

About Laser Photonics Corporation

Laser Photonics is a vertically integrated manufacturer and R&D Center of Excellence for industrial laser technologies and systems. Laser Photonics seeks to disrupt the $46 billion, centuries-old sand and abrasives blasting markets, focusing on surface cleaning, rust removal, corrosion control, de-painting and other laser-based industrial applications. Laser Photonics' new generation of leading-edge laser blasting technologies and equipment also addresses the numerous health, safety, environmental and regulatory issues associated with old methods. As a result, Laser Photonics quickly gained a reputation as an industry leader in industrial laser systems with a brand that stands for quality, technology and product innovation. Currently, world-renowned and Fortune 1000 manufacturers in the aviation, aerospace, automotive, defense, energy, maritime, nuclear and space-exploration industries are using Laser Photonics' "unique-to-industry" systems. For more information, visit https://www.laserphotonics.com.

Cautionary Note Concerning Forward-Looking Statements

This press release contains "forward-looking statements" (within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended), including statements regarding the Company's plans, prospects, potential results and use of proceeds. These statements are based on current expectations as of the date of this press release and involve a number of risks and uncertainties, which may cause results and uses of proceeds to differ materially from those indicated by these forward-looking statements. These risks include, without limitation, those described under the caption "Risk Factors" in our Form 10-K for the fiscal year ended December 31, 2024. Any reader of this press release is cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this press release. The Company undertakes no obligation to revise or update any forward-looking statements to reflect events or circumstances after the date of this press release except as required by applicable laws or regulations.

Laser Photonics Investor Relations Contact:

Brian Siegel, IRC, MBA

Senior Managing Director

Hayden IR

(346) 396-8696

[email protected]

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, except par value data)

(unaudited)

As of June 30, 2025 (Unaudited) | As of December 31, 2024 (Audited) | |||

Assets | ||||

Current Assets: | ||||

Cash and Cash Equivalents | $ | 78,522 | $ | 533,871 |

Accounts Receivable, Net | 877,522 | 973,605 | ||

Contract Assets | 657,103 | 759,658 | ||

Inventory | 1,476,637 | 2,338,759 | ||

Other Assets | 256,118 | 58,567 | ||

Total Current Assets | 3,345,902 | 4,664,460 | ||

Property, Plant, & Equipment, Net | 1,652,952 | 1,872,034 | ||

Intangible Assets, Net | 5,138,861 | 5,458,522 | ||

Other Long Term Assets | 316,378 | 316,378 | ||

Operating Lease Right-of-Use Asset | 4,486,758 | 4,840,753 | ||

Total Assets | $ | 14,940,851 | $ | 17,152,147 |

Liabilities & Stockholders' Equity | ||||

Current Liabilities: | ||||

Accounts Payable | $ | 1,484,062 | $ | 531,268 |

Account payable - affiliates/RP | 126,739 | 27,988 | ||

Short term loan | 1,210,923 | - | ||

Short term loan - affiliates/ RP | 620,000 | - | ||

Deferred Revenue | 319,872 | 55,383 | ||

Contract Liabilities | 1,577,417 | 1,042,090 | ||

Current Portion of Operating Lease | 440,468 | 649,989 | ||

Accrued Expenses | 562,342 | 266,717 | ||

Total Current Liabilities | 6,341,823 | 2,573,435 | ||

Long Term Liabilities: | ||||

Lease liability - less current | 4,262,061 | 4,366,419 | ||

Total Long Term Liabilities | 4,262,061 | 4,366,419 | ||

Total Liabilities | 10,603,884 | 6,939,854 | ||

Stockholders' Equity: | ||||

Preferred stock Par value $0.001: 10,000,000 shares authorized. 0 Issued: 0 shares were outstanding as of June 30, 2025 and December 31, 2024 | - | - | ||

Common Stock Par Value $0.001: 100,000,000 shares authorized; 14,301,087 issued and 14,276,150 outstanding as of June 301, 2025 and 14,282,395 issued and 14,257,458 outstanding as of December 31, 2024 | 14,276 | 14,257 | ||

Additional Paid in Capital | 15,565,439 | 17,886,159 | ||

Retained Earnings (Deficit) | (11,208,938 | ) | (7,754,313 | ) |

Shares to be issued | - | 100,000 | ||

Treasury Stock | (33,810 | ) | (33,810 | ) |

Total Stockholders' Equity | 4,336,967 | 10,212,293 | ||

Total Liabilities & Stockholders' Equity | $ | 14,940,851 | $ | 17,152,147 |

STATEMENTS OF PROFIT AND LOSS

(in thousands, except per share data)

(unaudited)

3 Months Ended | 6 Months Ended | |||||||||||

June 30,2025 (Unaudited) | June 30, 2024 (Unaudited) | June 30,2025 (Unaudited) | June 30, 2024 (Unaudited) | |||||||||

Net Sales | $ | 2,598,975 | $ | 623,435 | $ | 4,889,257 | $ | 1,366,426 | ||||

Cost of Sales | 1,208,871 | 308,081 | 2,359,387 | 665,204 | ||||||||

Gross Profit | 1,390,104 | 315,354 | 2,529,870 | 701,222 | ||||||||

Operating Expenses: | ||||||||||||

Sales & Marketing | 256,635 | 266,282 | 874,334 | 402,891 | ||||||||

General & Administrative | 697,265 | 435,776 | 1,597,299 | 792,042 | ||||||||

Depreciation & Amortization | 339,123 | 245,894 | 576,134 | 431,210 | ||||||||

Payroll Expenses | 928,482 | 238,703 | 1,769,343 | 447,158 | ||||||||

Research and Development Cost | 131,287 | 60,232 | 247,973 | 107,923 | ||||||||

Total Operating Expenses | 2,352,792 | 1,246,887 | 5,065,083 | 2,181,224 | ||||||||

Operating Income (Loss) | (962,688 | ) | (931,533 | ) | (2,535,213 | ) | (1,480,002 | ) | ||||

Other Income (Expense): | ||||||||||||

Interest Expense | (813,400 | ) | ||||||||||

Other Income | 2,186 | |||||||||||

Total Other Income (Loss) | (811,214 | ) | (2,723 | ) | (919,412 | ) | 37 | |||||

Income (Loss) Before Tax | (1,773,902 | ) | (934,256 | ) | (3,454,625 | ) | (1,479,965 | ) | ||||

Tax Provision | - | - | - | - | ||||||||

Net Income (Loss) | $ | (1,773,902 | ) | $ | (934,256 | ) | $ | (3,454,625 | ) | $ | (1,479,965 | ) |

Deemed Dividend from Software Acquisition | (6,615,000 | ) | (6,615,000 | ) | ||||||||

Net Comprehensive loss attributed to Common Shareholders | (1,773,902 | ) | (7,549,256 | ) | (3,454,625 | ) | (8,094,965 | ) | ||||

Earning (Loss) per Share: | ||||||||||||

Basic and diluted | $ | (0.12 | ) | $ | (0.09 | ) | $ | (0.24 | ) | $ | (0.15 | ) |

Loss per share (attributable to common shareholders) | (0.12 | ) | (0.71 | ) | (0.24 | ) | (0.82 | ) | ||||

Weighted Average of Shares Outstanding | 14,276,150 | 10,589,108 | 14,273,878 | 9,924,908 | ||||||||

Statement of Cash Flows

(in thousands)

(unaudited)

2025 (Unaudited) | 2024 (Unaudited) | |||||

OPERATING ACTIVITIES | ||||||

Net Loss/Gain | $ | (3,454,625 | ) | $ | (1,479,965 | ) |

Adjustments to Reconcile Net Loss to Net Cash Flow from Operating Activities: | ||||||

Bad Debt | 7,655 | - | ||||

Debt discount amortization | 71,008 | - | ||||

Shares issued for compensation | 33,336 | |||||

Distribution to affiliate | (2,420,701 | ) | (2,198,993 | ) | ||

Depreciation & Amortization | 576,134 | 431,210 | ||||

Change in Operating Assets & Liabilities: | ||||||

Accounts Receivable | 88,429 | 370,348 | ||||

Contract Assets | 102,555 | - | ||||

Inventory | 847,289 | 132,034 | ||||

Prepaids & Other Current Assets | (197,553 | ) | (366,448 | ) | ||

Net Change, Right-of-Use Asset & Liabilities | 40,118 | - | ||||

Accounts Payable | 1,051,545 | (24,804 | ) | |||

Contract Liabilities | 535,327 | - | ||||

Accrued Expenses | 295,625 | (53,924 | ) | |||

Deferred Revenue | 264,490 | (96,550 | ) | |||

Net Cash Used in Operating Activities | (2,192,704 | ) | (3,253,756 | ) | ||

INVESTING ACTIVITIES | ||||||

Purchase of Property, Plant an Equipment | - | (12,934 | ) | |||

Purchase of Research & Development Equipment | (6,900 | ) | (4,095 | ) | ||

Leasehold Improvements | (15,660 | ) | (182,719 | ) | ||

Net Cash Used in Investing Activities | (22,560 | ) | (199,748 | ) | ||

FINANCING ACTIVITIES | ||||||

IPFS Loan | (29,458 | ) | - | |||

Borrowings on debt | 2,550,000 | - | ||||

Borrowings on debt | (1,380,627 | ) | - | |||

Short term Loan From Affiliate | 620,000 | - | ||||

Common stock .01 x 100,000,000 | - | (92,533 | ) | |||

Common stock .001 x 100,000,000 | - | 12,253 | ||||

Additional Paid in Capital | - | 80,280 | ||||

Net Cash provided by (used in) Financing Activities | 1,759,915 | - | ||||

Net Cash Flow for Period | (455,349 | ) | (3,453,504 | ) | ||

Cash and Cash Equivalents - Beginning of Period | 533,871 | 6,201,137 | ||||

Cash and Cash Equivalents- End of Period | $ | 78,522 | $ | 2,747,633 | ||

NON-CASH INVESTING AND FINANCING ACTIVITIES | ||||||

Shares issued for Investment | 100,000 | - | ||||

Transfer demo inventory to PPE | 14,833 | - | ||||

Share issued for purchase of license | - | 6,615,000 | ||||

SOURCE: Laser Photonics Corp.

View the original press release on ACCESS Newswire

T.Perez--AT