-

Gremaud ends Gu's Olympic treble bid with freeski slopestyle gold

Gremaud ends Gu's Olympic treble bid with freeski slopestyle gold

-

Howe would 'step aside' if right for Newcastle

-

Sakamoto wants 'no regrets' as gold beckons in Olympic finale

Sakamoto wants 'no regrets' as gold beckons in Olympic finale

-

What next for Vonn after painful end of Olympic dream?

-

Brain training reduces dementia risk by 25%, study finds

Brain training reduces dementia risk by 25%, study finds

-

Gremaud ends Gu's hopes of Olympic treble in freeski slopestyle

-

Shiffrin and Johnson paired in Winter Olympics team combined

Shiffrin and Johnson paired in Winter Olympics team combined

-

UK's Starmer scrambles to limit Epstein fallout as aides quit

-

US skater Malinin 'full of confidence' after first Olympic gold

US skater Malinin 'full of confidence' after first Olympic gold

-

Sydney police pepper spray protesters during rallies against Israeli president's visit

-

Tokyo stocks hit record high after Japanese premier wins vote

Tokyo stocks hit record high after Japanese premier wins vote

-

Israel says killed four militants exiting Gaza tunnel

-

Franzoni sets pace in Olympic team combined

Franzoni sets pace in Olympic team combined

-

Captain's injury agony mars 'emotional' Italy debut at T20 World Cup

-

Family matters: Thaksin's party down, maybe not out

Family matters: Thaksin's party down, maybe not out

-

African players in Europe: Ouattara fires another winner for Bees

-

Pressure grows on UK's Starmer over Epstein fallout

Pressure grows on UK's Starmer over Epstein fallout

-

Music world mourns Ghana's Ebo Taylor, founding father of highlife

-

HK mogul's ex-workers 'broke down in tears' as they watched sentencing

HK mogul's ex-workers 'broke down in tears' as they watched sentencing

-

JD Vance set for Armenia, Azerbaijan trip

-

Sydney police deploy pepper spray as Israeli president's visit sparks protests

Sydney police deploy pepper spray as Israeli president's visit sparks protests

-

EU warns Meta it must open up WhatsApp to rival AI chatbots

-

Scotland spoil Italy's T20 World Cup debut with big win

Scotland spoil Italy's T20 World Cup debut with big win

-

Stocks track Wall St rally as Tokyo hits record on Takaichi win

-

Israeli president says 'we will overcome evil' at Bondi Beach

Israeli president says 'we will overcome evil' at Bondi Beach

-

Munsey leads Scotland to 207-4 against Italy at T20 World Cup

-

Venezuela's Machado says ally 'kidnapped' after his release

Venezuela's Machado says ally 'kidnapped' after his release

-

Japan restarts world's biggest nuclear plant again

-

Bangladesh poll rivals rally on final day of campaign

Bangladesh poll rivals rally on final day of campaign

-

Third impeachment case filed against Philippine VP Duterte

-

Wallaby winger Nawaqanitawase heads to Japan

Wallaby winger Nawaqanitawase heads to Japan

-

Thailand's Anutin rides wave of nationalism to election victory

-

Venezuela's Machado says ally kidnapped by armed men after his release

Venezuela's Machado says ally kidnapped by armed men after his release

-

Maye longs for do-over as record Super Bowl bid ends in misery

-

Seahawks' Walker rushes to Super Bowl MVP honors

Seahawks' Walker rushes to Super Bowl MVP honors

-

Darnold basks in 'special journey' to Super Bowl glory

-

Japan's Takaichi may struggle to soothe voters and markets

Japan's Takaichi may struggle to soothe voters and markets

-

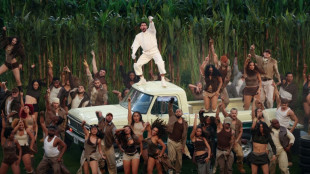

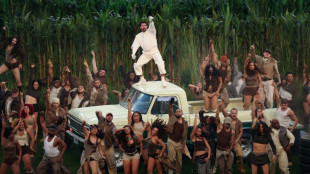

Bad Bunny celebrates Puerto Rico at Super Bowl, angering Trump

-

Seahawks soar to Super Bowl win over Patriots

Seahawks soar to Super Bowl win over Patriots

-

'Want to go home': Indonesian crew abandoned off Africa demand wages

-

Asian stocks track Wall St rally as Tokyo hits record on Takaichi win

Asian stocks track Wall St rally as Tokyo hits record on Takaichi win

-

Hong Kong sentences pro-democracy mogul Jimmy Lai to 20 years in jail

-

Bad Bunny celebrates Puerto Rico in joyous Super Bowl halftime show

Bad Bunny celebrates Puerto Rico in joyous Super Bowl halftime show

-

Three prominent opposition figures released in Venezuela

-

Japan PM Takaichi basks in historic election triumph

Japan PM Takaichi basks in historic election triumph

-

Israeli president says 'we shall overcome this evil' at Bondi Beach

-

'Flood' of disinformation ahead of Bangladesh election

'Flood' of disinformation ahead of Bangladesh election

-

Arguments to begin in key US social media addiction trial

-

NFL Alumni Health Partners with Wellgistics Health to Deploy Technology to Improve Health Outcomes for Former NFL Players and Rural Communities

NFL Alumni Health Partners with Wellgistics Health to Deploy Technology to Improve Health Outcomes for Former NFL Players and Rural Communities

-

ARIA Cybersecurity and Acronis Debut Windows 10 End of Support Extension of Life Solution

Capstone to Acquire Carolina Stone Products-Immediately Accretive to Revenue and EBITDA; Closing Targeted by August 22, 2025

Deal adds premium brands and North Carolina footprint; pipeline remains active at 4-6× EBITDA valuation range with 20-45% non-cash consideration

NEW YORK, NY / ACCESS Newswire / August 18, 2025 / Capstone Holding Corp. (NASDAQ:CAPS), a national building products distribution platform, today announced it has signed a definitive agreement to acquire Carolina Stone Products, with closing targeted by August 22, 2025, subject to customary conditions. Additional details are included in the Company's Form 8-K filed today.

Transaction Highlights

Target: Carolina Stone Products (North Carolina)

Closing: Targeted by August 22, 2025

Financials (trailing):Revenue ≈ $11 million; LTM EBITDA ≈ $0.75 million/ 2026 ≈ 1.001 million

Purchase price / multiple:$3.9-$4.7 million (~4.7×-5.2× EBITDA)

Accretion: Immediately accretive to revenue and EBITDA at close

Strategic fit: Expands Southeast footprint; adds premium brands; supports margin expansion

Management estimate of 2026 EBITDA contribution

Carolina Stone Products Acquisition - The transaction will add Carolina Stone's premium brands and loyal customer base to Capstone's portfolio. It is expected to be immediately accretive to revenue and EBITDA and will mark Capstone's entry into the Southeast, one of the nation's fastest-growing construction markets.

"With a foothold in the Carolinas, we'll begin getting Instone products on the ground right away-a key step toward share gains and margin expansion," said Matthew Lipman, CEO. "We are delivering on our 2025 plan: immediately accretive acquisitions, a disciplined pipeline at 4-6× EBITDA, and a clear path to a ~$100 million revenue run-rate entering 2026."

"We couldn't be more thrilled about joining the Capstone family," added Stuart Powell, Carolina Stone

Products EVP. "We believe the additional products for our customers to access along with an ability to

serve our large, production builders in new markets via the Capstone reach will make us an even more

valuable partner."

Additional Acquisitions - Capstone expects to close at least one additional acquisition by year-end 2025. Multiple targets are under review at 4-6× EBITDA valuations, with 20-45% non-cash consideration, positioning Capstone to make a third acquisition and enter 2026 at a ~$100 million revenue run-rate.

The company's disciplined approach to M&A has fueled significant platform growth. Previous acquisitions - including HHT's stone business, Heller's Stone, and Northeast Masonry - have expanded Capstone's footprint, lowered costs, strengthened supply chains, and elevated customer service.

"In building products, scale matters," Lipman added. "Larger companies enjoy competitive advantages like pricing power, operational leverage, and broader reach. Our platform and team give us the ability to capture those benefits and deliver long-term value creation."

In addition to pipeline progress, Capstone last week reported that Q2 gross margins rose to 24.4% from 21.4% a year earlier, driven by increased sales of owned brands and disciplined cost management. These results underscore the company's execution of its long-term growth strategy: pairing organic expansion with well-timed acquisitions.

"We're doing what we set out to do," said Lipman. "With our flexible capital structure and deep sector expertise, we're well-positioned to continue executing on our strategy in the months ahead."

About Capstone Holding Corp.

Capstone Holding Corp. (NASDAQ:CAPS) is a diversified platform of building products businesses focused on distribution, brand ownership, and acquisition. Through its Instone subsidiary, Capstone serves 31 U.S. states, offering proprietary stone veneer, hardscape materials, and modular masonry systems. The company's strategy combines disciplined M&A, operational efficiency, and a growing portfolio of owned brands to build a scalable and durable platform.

Investor Contact:

Investor Relations

Capstone Holding Corp.

[email protected]

www.capstoneholdingcorp.com

Forward-Looking Statements

This press release contains forward-looking statements as defined by the Private Securities Litigation Reform Act of 1995. These statements relate to future events and performance, including guidance regarding revenue and EBITDA targets, M&A strategy, use of capital, and operating outlook. Actual results may differ materially from those projected due to a range of factors, including but not limited to acquisition timing, macroeconomic conditions, and execution risks. Please review the Company's filings with the SEC for a full discussion of risk factors. Capstone undertakes no obligation to revise forward-looking statements except as required by law.

SOURCE: Capstone Holding Corp.

View the original press release on ACCESS Newswire

T.Wright--AT