-

New Zealand ex-top cop avoids jail time for child abuse, bestiality offences

New Zealand ex-top cop avoids jail time for child abuse, bestiality offences

-

Eurovision facing fractious 2026 as unity unravels

-

'Extremely exciting': the ice cores that could help save glaciers

'Extremely exciting': the ice cores that could help save glaciers

-

Asian markets drift as US jobs data fails to boost rate cut hopes

-

What we know about Trump's $10 billion BBC lawsuit

What we know about Trump's $10 billion BBC lawsuit

-

Ukraine's lost generation caught in 'eternal lockdown'

-

'Catastrophic mismatch': Safety fears as Jake Paul faces Anthony Joshua

'Catastrophic mismatch': Safety fears as Jake Paul faces Anthony Joshua

-

Australia's Steve Smith ruled out of third Ashes Test

-

Khawaja grabs lifeline as Australia reach 94-2 in 3rd Ashes Test

Khawaja grabs lifeline as Australia reach 94-2 in 3rd Ashes Test

-

Undefeated boxing great Crawford announces retirement

-

Trump says orders blockade of 'sanctioned' Venezuela oil tankers

Trump says orders blockade of 'sanctioned' Venezuela oil tankers

-

UK experiences sunniest year on record

-

Australia holds first funeral for Bondi Beach attack victims

Australia holds first funeral for Bondi Beach attack victims

-

FIFA announces $60 World Cup tickets after pricing backlash

-

Maresca relishes support of Chelsea fans after difficult week

Maresca relishes support of Chelsea fans after difficult week

-

Players pay tribute to Bondi victims at Ashes Test

-

Costa Rican president survives second Congress immunity vote

Costa Rican president survives second Congress immunity vote

-

Married couple lauded for effort to thwart Bondi Beach shootings

-

Australia holds first funerals for Bondi Beach attack victims

Australia holds first funerals for Bondi Beach attack victims

-

Trump has 'alcoholic's personality,' chief of staff says in bombshell interview

-

Rob Reiner killing: son to be charged with double murder

Rob Reiner killing: son to be charged with double murder

-

Chelsea battle into League Cup semis to ease pressure on Maresca

-

Netflix boss promises Warner Bros films would still be seen in cinemas

Netflix boss promises Warner Bros films would still be seen in cinemas

-

Grok spews misinformation about deadly Australia shooting

-

Stocks mostly retreat on US jobs, oil drops on Ukraine hopes

Stocks mostly retreat on US jobs, oil drops on Ukraine hopes

-

Artificial snow woes for Milan-Cortina Winter Olympics organisers

-

Trump imposes full travel bans on seven more countries, Palestinians

Trump imposes full travel bans on seven more countries, Palestinians

-

New Chile leader calls for end to Maduro 'dictatorship'

-

Shiffrin extends slalom domination with Courchevel win

Shiffrin extends slalom domination with Courchevel win

-

Doctor sentenced for supplying ketamine to 'Friends' star Perry

-

Tepid 2026 outlook dents Pfizer shares

Tepid 2026 outlook dents Pfizer shares

-

Rob Reiner murder: son not medically cleared for court

-

FIFA announces $60 World Cup tickets for 'loyal fans'

FIFA announces $60 World Cup tickets for 'loyal fans'

-

Dembele and Bonmati scoop FIFA Best awards

-

Shiffrin dominates first run in Courchevel slalom

Shiffrin dominates first run in Courchevel slalom

-

EU weakens 2035 combustion-engine ban to boost car industry

-

Arctic sees unprecedented heat as climate impacts cascade

Arctic sees unprecedented heat as climate impacts cascade

-

French lawmakers adopt social security budget, suspend pension reform

-

Afrikaners mark pilgrimage day, resonating with their US backers

Afrikaners mark pilgrimage day, resonating with their US backers

-

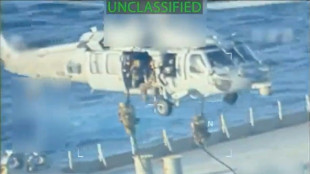

Lawmakers grill Trump officials on US alleged drug boat strikes

-

Hamraoui loses case against PSG over lack of support after attack

Hamraoui loses case against PSG over lack of support after attack

-

Trump - a year of ruling by executive order

-

Iran refusing to allow independent medical examination of Nobel winner: family

Iran refusing to allow independent medical examination of Nobel winner: family

-

Brazil megacity Sao Paulo struck by fresh water crisis

-

Australia's Green becomes most expensive overseas buy in IPL history

Australia's Green becomes most expensive overseas buy in IPL history

-

VW stops production at German site for first time

-

Man City star Doku sidelined until new year

Man City star Doku sidelined until new year

-

Rome's new Colosseum station reveals ancient treasures

-

EU eases 2035 combustion-engine ban to boost car industry

EU eases 2035 combustion-engine ban to boost car industry

-

'Immense' collection of dinosaur footprints found in Italy

Stocks rally rolls on in US, mixed elsewhere

Wall Street stocks pushed higher for a third day on Thursday but the rally fizzled elsewhere as China poured cold water on US President Donald Trump's comments talking up prospects of a deal to end their trade war.

US stocks tanked on Monday after comments by Trump sparked fears he would try to remove Federal Reserve chief Jerome Powell.

But global markets rebounded on Tuesday after Trump indicated he had no intention to oust Powell, also signaling that tariffs on China could be substantially lowered and that the United States would have a "fair deal" on trade with Beijing.

But China on Thursday denied that any "economic and trade negotiations" are taking place with Washington.

Treasury Secretary Scott Bessent also tempered optimism, saying the two countries were "not yet" talking when it comes to lowering tariffs.

Those comments led to a mostly lower session in Asia and early losses in Europe, which nevertheless ended the day with small gains.

However, Wall Street pushed higher after a mixed open, finishing solidly higher for a third straight day.

Thursday's gains are part of a "relief rally" that is persisting, said Adam Sarhan of 50 Park Investments.

"The last few times the market has gone down a lot, Trump has changed his stance and he's done so quickly," said Sarhan. "When the markets move, Trump listens."

The dollar weakened as White House uncertainty boosted demand for the Swiss franc, the yen and gold, seen as safe-haven assets.

Meanwhile investors were also looking to a series of company results for signs of how tariffs may weigh on the outlook for the year ahead.

"Comments about tariffs from business leaders are omnipresent and investors want to know how companies plan to deal with potential cost pressures," said Russ Mould, investment director at AJ Bell.

Shares in consumer goods manufacturer Procter & Gamble slumped 3.7 percent after it cut its sales and profit forecasts, citing a pullback by consumers amid the tariff and economic uncertainty.

Shares in its British rival Unilever shed 0.3 percent although it said the impact of US tariffs on its products would be "limited", as it reported a dip in first-quarter revenue.

Shares in Pepsi slid nearly five percent after it too cut its 2025 sales and profit forecasts.

Japanese auto giant Nissan predicted an enormous loss of around five billion dollars this year as US President Donald Trump's tariffs on car imports hit the industry.

In Paris, shares in luxury group Kering fell 1.6 percent after it reported a further sales slump at its flagship Gucci brand.

In Frankfurt, German sportswear giant Adidas gained 2.9 percent as its profit almost doubled in the first quarter, beating expectations.

Meanwhile Nintendo shares gained as much as 5.5 percent after the gaming giant boasted of higher-than-expected demand in Japan for pre-orders of its Switch 2 game console.

- Key figures at 2030 GMT -

New York - Dow: UP 1.2 percent at 40,093.40 (close)

New York - S&P 500: UP 2.0 percent at 5,484.77 (close)

New York - Nasdaq Composite: UP 2.7 percent at 17,166.04 (close)

London - FTSE 100: UP 0.1 percent at 8,407.44 (close)

Paris - CAC 40: UP 0.3 percent at 7,502.78 (close)

Frankfurt - DAX: UP 0.5 percent at 22,064.51 (close)

Tokyo - Nikkei 225: UP 0.5 percent at 35,039.15 (close)

Hong Kong - Hang Seng Index: DOWN 0.7 percent at 21,909.76 (close)

Shanghai - Composite: FLAT at 3,297.29 (close)

Euro/dollar: UP at $1.1392 from $1.1316 on Wednesday

Pound/dollar: UP at $1.3339 from $1.3254

Dollar/yen: DOWN at 142.62 from 143.45 yen

Euro/pound: DOWN at 85.35 from 85.37 pence

West Texas Intermediate: UP 0.8 percent at $62.79 per barrel

Brent North Sea Crude: UP 0.7 percent at $66.55 per barrel

burs-jmb/md

M.O.Allen--AT