-

Oscars to stream exclusively on YouTube from 2029: Academy

Oscars to stream exclusively on YouTube from 2029: Academy

-

CNN's future unclear as Trump applies pressure

-

Brazil threatens to walk if EU delays Mercosur deal

Brazil threatens to walk if EU delays Mercosur deal

-

Zelensky says Russia preparing for new 'year of war'

-

Rob Reiner's son appears in court over parents' murder

Rob Reiner's son appears in court over parents' murder

-

US Congress passes defense bill defying Trump anti-Europe rhetoric

-

Three Russia-themed anti-war films shortlisted for Oscars

Three Russia-themed anti-war films shortlisted for Oscars

-

US oil blockade of Venezuela: what we know

-

Palace boss Glasner says contract talks on hold due to hectic schedule

Palace boss Glasner says contract talks on hold due to hectic schedule

-

Netflix to launch FIFA World Cup video game

-

Venezuela says oil exports continue normally despite Trump 'blockade'

Venezuela says oil exports continue normally despite Trump 'blockade'

-

German MPs approve 50 bn euros in military purchases

-

India v South Africa 4th T20 abandoned due to fog

India v South Africa 4th T20 abandoned due to fog

-

Hydrogen plays part in global warming: study

-

EU's Mercosur trade deal hits French, Italian roadblock

EU's Mercosur trade deal hits French, Italian roadblock

-

What next for Belarus after US deal on prisoners, sanctions?

-

Brazil Senate debates bill that could slash Bolsonaro jail term

Brazil Senate debates bill that could slash Bolsonaro jail term

-

Coe shares 'frustration' over marathon record despite Kenyan's doping ban

-

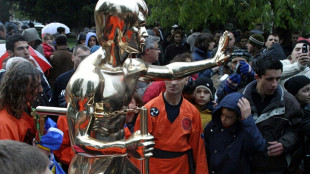

Stolen Bruce Lee statue 'returns' to Bosnia town

Stolen Bruce Lee statue 'returns' to Bosnia town

-

Veteran Suarez signs new Inter Miami contract

-

Warner Bros rejects Paramount bid, sticks with Netflix

Warner Bros rejects Paramount bid, sticks with Netflix

-

Crude prices surge after Trump orders Venezuela oil blockade

-

Balkan nations offer lessons on handling cow virus sowing turmoil

Balkan nations offer lessons on handling cow virus sowing turmoil

-

French readers lap up Sarkozy's prison diaries

-

UK PM warns Abramovich 'clock is ticking' over Chelsea sale fund

UK PM warns Abramovich 'clock is ticking' over Chelsea sale fund

-

Warner Bros. Discovery rejects Paramount bid

-

Winners of 2026 World Cup to pocket $50 million in prize money

Winners of 2026 World Cup to pocket $50 million in prize money

-

World no. 1 Alcaraz ends 'incredible ride' with coach Ferrero

-

World number one Alcaraz announces 'difficult' split with coach Ferrero

World number one Alcaraz announces 'difficult' split with coach Ferrero

-

Iran boxer sentenced to death at 'imminent' risk of execution: rights groups

-

Snicko operator admits error that led to Carey's Ashes reprieve

Snicko operator admits error that led to Carey's Ashes reprieve

-

Finland PM apologises to Asian countries over MPs' mocking posts

-

Doctors in England go on strike for 14th time

Doctors in England go on strike for 14th time

-

Romania journalists back media outlet that sparked graft protests

-

Rob Reiner's son awaiting court appearance on murder charges

Rob Reiner's son awaiting court appearance on murder charges

-

Ghana's Highlife finds its rhythm on UNESCO world stage

-

Stocks gain as traders bet on interest rate moves

Stocks gain as traders bet on interest rate moves

-

France probes 'foreign interference' after malware found on ferry

-

Europe's Ariane 6 rocket puts EU navigation satellites in orbit

Europe's Ariane 6 rocket puts EU navigation satellites in orbit

-

Bleak end to the year as German business morale drops

-

Hundreds queue at Louvre museum as strike vote delays opening

Hundreds queue at Louvre museum as strike vote delays opening

-

Bondi shooting shocks, angers Australia's Jewish community

-

Markets rise even as US jobs data fail to boost rate cut bets

Markets rise even as US jobs data fail to boost rate cut bets

-

Senegal talisman Mane overcame grief to become an African icon

-

Carey pays tribute to late father after home Ashes century

Carey pays tribute to late father after home Ashes century

-

'Many lessons to be learned' from Winter Games preparations, says ski chief

-

Emotional Carey slams ton to give Australia upper hand in 3rd Ashes Test

Emotional Carey slams ton to give Australia upper hand in 3rd Ashes Test

-

Asian markets mixed as US jobs data fails to boost rate cut hopes

-

Carey slams ton as Australia seize upper hand in third Ashes Test

Carey slams ton as Australia seize upper hand in third Ashes Test

-

Bondi shooting shocks, angers Australia Jewish community

| CMSC | -0.31% | 23.268 | $ | |

| NGG | 1.65% | 77.04 | $ | |

| GSK | 0.28% | 48.916 | $ | |

| RIO | 1.62% | 77.24 | $ | |

| BTI | -0.18% | 57.185 | $ | |

| BCC | -0.22% | 75.67 | $ | |

| SCS | 0.12% | 16.14 | $ | |

| RYCEF | -0.2% | 14.77 | $ | |

| BP | 1.47% | 34.265 | $ | |

| BCE | -0.6% | 23.19 | $ | |

| AZN | -1.1% | 90.36 | $ | |

| JRI | -0.72% | 13.413 | $ | |

| CMSD | -0.73% | 23.21 | $ | |

| RBGPF | 0.5% | 82.01 | $ | |

| VOD | 0.9% | 12.815 | $ | |

| RELX | -0.57% | 40.59 | $ |

Stocks rally fades along with hopes of quick US-China trade deal

A rally on global stock markets fizzled Thursday as China poured cold water on US President Donald Trump's comments talking up the prospects of a deal to end their trade war.

It follows a jump in markets the previous day as Trump signalled that tariffs on China could be substantially lowered and that the United States would have a "fair deal" on trade with Beijing.

But China on Thursday said any claims of ongoing trade talks with Washington were "groundless".

Treasury Secretary Scott Bessent also tempered optimism, saying the two countries are "not yet" talking when it comes to lowering tariffs.

"The investing world is back to hanging onto every word out of the White House, but with such a confusing and often contradictory stance on tariffs, volatility is all we can really guarantee," said Matt Britzman, senior equity analyst at Hargreaves Lansdown.

City Index and FOREX.com analyst Fawad Razaqzada said that "until we see meaningful resolution on the tariff front, it may well be the case that markets remain in a choppy environment with larger-than-usual swings."

Wall Street opened mixed, while European equities were lower in afternoon trading.

In Asia, Tokyo closed 0.5 percent higher, while Shanghai ended flat and Hong Kong fell almost one percent.

Seoul fell after official data showed South Korea's economy unexpectedly contracted 0.1 percent in the first three months of 2025.

The dollar weakened as White House uncertainty boosted demand for the Swiss franc, the yen and gold, seen as safe-haven assets.

Bessent also said that in its talks with Japan on tariffs, Washington had "absolutely no currency targets", after repeated comments from Trump that he wants a stronger yen.

Meanwhile investors are also looking to a series of company results for signs of how tariffs may weigh on the outlook for the year ahead.

"Comments about tariffs from business leaders are omnipresent and investors want to know how companies plan to deal with potential cost pressures," said Russ Mould, investment director at AJ Bell.

Shares in consumer goods manufacturer Procter & Gamble slumped 3.5 percent after it cut its sales and profit forecasts, citing a pullback by consumers amid the tariff and economic uncertainty.

Shares in its British rival Unilever shed 0.5 percent although it said the impact of US tariffs on its products would be "limited", as it reported a dip in first-quarter revenue.

Shares in Pepsi slid 1.8 percent after it too cut its 2025 sales and profit forecasts.

Japanese auto giant Nissan predicted an enormous loss of around five billion dollars this year as US President Donald Trump's tariffs on car imports hit the industry.

In Paris, shares in luxury group Kering fell 2.5 percent after it reported a further sales slump at its flagship Gucci brand.

In Frankfurt, German sportswear giant Adidas gained around three percent as its profit almost doubled in the first quarter, beating expectations.

Meanwhile Nintendo shares gained as much as 5.5 percent after the gaming giant boasted of higher-than-expected demand in Japan for pre-orders of its Switch 2 game console.

- Key figures at 1330 GMT -

New York - Dow: DOWN 0.4 percent at 39,462.82 points

New York - S&P 500: UP less than 0.1 percent at 5,379.94

New York - Nasdaq Composite: UP 0.3 percent at 16,755.08

London - FTSE 100: DOWN 0.3 percent at 8,375.18

Paris - CAC 40: DOWN 0.1 percent at 7,473.14

Frankfurt - DAX: DOWN 0.2 percent at 21,913.61

Tokyo - Nikkei 225: UP 0.5 percent at 35,039.15 (close)

Hong Kong - Hang Seng Index: DOWN 0.7 percent at 21,909.76 (close)

Shanghai - Composite: FLAT at 3,297.29 (close)

Euro/dollar: UP at $1.1377 from $1.1317 on Wednesday

Pound/dollar: UP at $1.3305 from $1.3257

Dollar/yen: DOWN at 142.40 from 143.49 yen

Euro/pound: UP at 85.51 from 85.34 pence

West Texas Intermediate: UP 0.9 percent at $62.82 per barrel

Brent North Sea Crude: UP 0.7 percent at $65.65 per barrel

burs-rl/jhb

P.Smith--AT