-

Russia makes 'proposal' to France over jailed researcher

Russia makes 'proposal' to France over jailed researcher

-

King Charles calls for 'reconciliation' in Christmas speech

-

Brazil's jailed ex-president Bolsonaro undergoes 'successful' surgery

Brazil's jailed ex-president Bolsonaro undergoes 'successful' surgery

-

UK tech campaigner sues Trump administration over US sanctions

-

New Anglican leader says immigration debate dividing UK

New Anglican leader says immigration debate dividing UK

-

Russia says made 'proposal' to France over jailed researcher

-

Bangladesh PM hopeful Rahman returns from exile ahead of polls

Bangladesh PM hopeful Rahman returns from exile ahead of polls

-

Police suspect suicide bomber behind Nigeria's deadly mosque blast

-

AFCON organisers allowing fans in for free to fill empty stands: source

AFCON organisers allowing fans in for free to fill empty stands: source

-

Mali coach Saintfiet hits out at European clubs, FIFA over AFCON changes

-

Pope urges Russia, Ukraine dialogue in Christmas blessing

Pope urges Russia, Ukraine dialogue in Christmas blessing

-

Last Christians gather in ruins of Turkey's quake-hit Antakya

-

Pope Leo condemns 'open wounds' of war in first Christmas homily

Pope Leo condemns 'open wounds' of war in first Christmas homily

-

Mogadishu votes in first local elections in decades under tight security

-

Prime minister hopeful Tarique Rahman arrives in Bangladesh

Prime minister hopeful Tarique Rahman arrives in Bangladesh

-

'Starting anew': Indonesians in disaster-struck Sumatra hold Christmas mass

-

Cambodian PM's wife attends funerals of soldiers killed in Thai border clashes

Cambodian PM's wife attends funerals of soldiers killed in Thai border clashes

-

Prime minister hopeful Tarique Rahman arrives in Bangladesh: party

-

Pacific archipelago Palau agrees to take migrants from US

Pacific archipelago Palau agrees to take migrants from US

-

Pope Leo expected to call for peace during first Christmas blessing

-

Australia opts for all-pace attack in fourth Ashes Test

Australia opts for all-pace attack in fourth Ashes Test

-

'We hold onto one another and keep fighting,' says wife of jailed Istanbul mayor

-

North Korea's Kim visits nuclear subs as Putin hails 'invincible' bond

North Korea's Kim visits nuclear subs as Putin hails 'invincible' bond

-

Trump takes Christmas Eve shot at 'radical left scum'

-

3 Factors That Affect the Cost of Dentures in San Antonio, TX

3 Factors That Affect the Cost of Dentures in San Antonio, TX

-

Leo XIV celebrates first Christmas as pope

-

Diallo and Mahrez strike at AFCON as Ivory Coast, Algeria win

Diallo and Mahrez strike at AFCON as Ivory Coast, Algeria win

-

'At your service!' Nasry Asfura becomes Honduran president-elect

-

Trump-backed Nasry Asfura declared winner of Honduras presidency

Trump-backed Nasry Asfura declared winner of Honduras presidency

-

Diallo strikes to give AFCON holders Ivory Coast winning start

-

Dow, S&P 500 end at records amid talk of Santa rally

Dow, S&P 500 end at records amid talk of Santa rally

-

Spurs captain Romero facing increased ban after Liverpool red card

-

Bolivian miners protest elimination of fuel subsidies

Bolivian miners protest elimination of fuel subsidies

-

A lack of respect? African football bows to pressure with AFCON change

-

Trump says comedian Colbert should be 'put to sleep'

Trump says comedian Colbert should be 'put to sleep'

-

Mahrez leads Algeria to AFCON cruise against Sudan

-

Southern California braces for devastating Christmas storm

Southern California braces for devastating Christmas storm

-

Amorim wants Man Utd players to cover 'irreplaceable' Fernandes

-

First Bond game in a decade hit by two-month delay

First Bond game in a decade hit by two-month delay

-

Brazil's imprisoned Bolsonaro hospitalized ahead of surgery

-

Serbia court drops case against ex-minister over train station disaster

Serbia court drops case against ex-minister over train station disaster

-

Investors watching for Santa rally in thin pre-Christmas trade

-

David Sacks: Trump's AI power broker

David Sacks: Trump's AI power broker

-

Delap and Estevao in line for Chelsea return against Aston Villa

-

Why metal prices are soaring to record highs

Why metal prices are soaring to record highs

-

Stocks tepid in thin pre-Christmas trade

-

UN experts slam US blockade on Venezuela

UN experts slam US blockade on Venezuela

-

Bethlehem celebrates first festive Christmas since Gaza war

-

Set-piece weakness costing Liverpool dear, says Slot

Set-piece weakness costing Liverpool dear, says Slot

-

Two police killed in explosion in Moscow

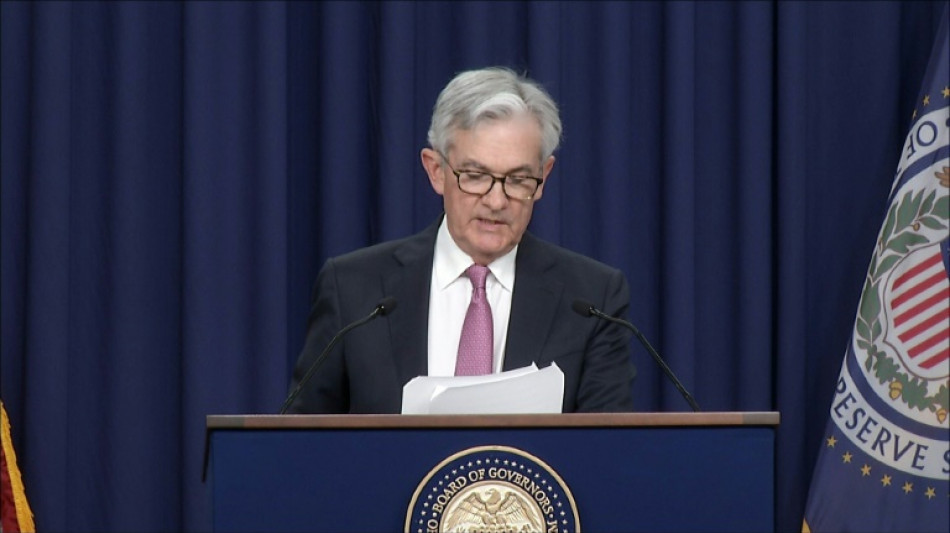

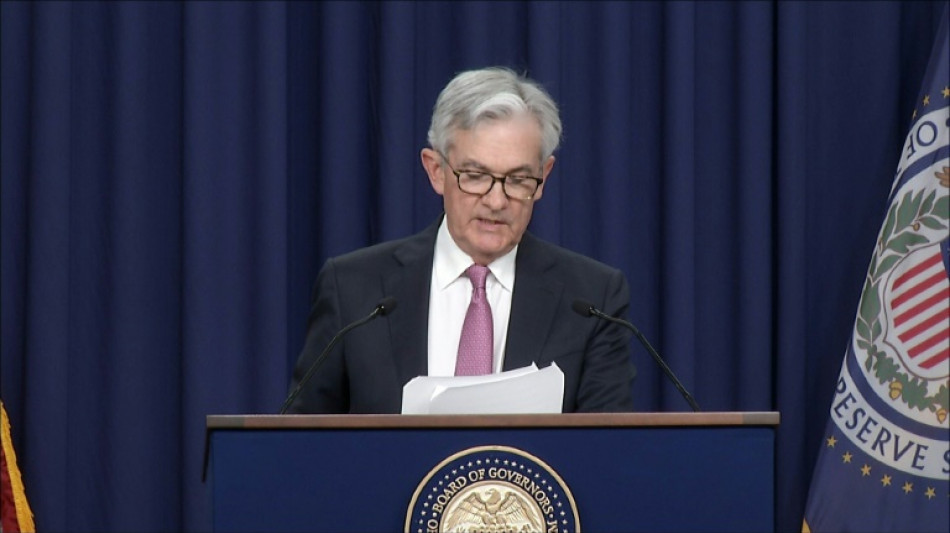

Asian markets rise as Fed eases fears over huge rate hike

US central bank officials announced an expected half-point lift in borrowing costs -- the biggest since 2000 -- as part of its battle to rein in inflation, while unveiling a timetable to offload its vast bond holdings.

However, traders were given some much-needed cheer when boss Jerome Powell said a 75 basis-point rise, which had been flagged by many observers, was not "not something the committee is actively considering".

While he flagged more 50-point hikes to come, the news fuelled a rally on Wall Street, where all three main indexes piled on around three percent thanks to a surge in tech firms, which are most susceptible to higher rates.

"This was a reflection of relief, as investors came into the meeting fearful that the committee would be overly aggressive in tightening monetary policy," said Clara Cheong, of JP Morgan Asset Management.

She added that if inflation began showing signs of slowing, it could allow the Fed to be less aggressive as it treads a fine line between containing prices and nurturing the pandemic economic recovery.

"It remains to be seen if the Fed can pull off this fine balancing act and orchestrate a soft landing, but for now we believe that the US economy is in a strong enough position to weather higher rates," Cheong said.

"There is still, however, a risk that an overly aggressive approach can run the risk of tipping the economy into a mild recession in 2023."

The gains in New York filtered through to Asia, where Shanghai advanced after returning from a long break while Hong Kong, Sydney, Singapore, Taipei, Manila and Wellington were also up.

"Removing some of the uncertainty is helpful in getting some of the cash that has been on the sideline back into the markets, whether it's bonds or equities," Erin Gibbs, of Main Street Asset Management, told Bloomberg Television.

The Fed hike was the latest by a central bank around the world and comes ahead of an expected lift by the Bank of England later Thursday.

Still, analysts warned there was only so much banking officials could do to bring inflation under control as the spike was also being fuelled by supply chain problems caused by China's Covid-related lockdowns and surging energy costs, particularly oil.

And crude extended Wednesday's big gains after the European Commission proposed a gradual ban on Russian crude over Moscow's invasion of Ukraine.

That was compounded by data showing stockpiles shrinking and a weaker dollar caused by lower expectations for US rate hikes.

"The oil market will remain tight going forward, and now that a peak in the dollar is in place, crude prices should have extra support here," said OANDA's Edward Moya.

- Key figures at around 0230 GMT -

Hong Kong - Hang Seng Index: UP 1.1 percent at 21,094.52

Shanghai - Composite: UP 0.7 percent at 3,067.58

Tokyo - Nikkei 225: Closed for a holiday

Brent North Sea crude: UP 0.1 percent at $110.27 per barrel

West Texas Intermediate: UP 0.1 percent at $107.91 per barrel

Euro/dollar: DOWN at $1.0619 from $1.0625 on Wednesday

Pound/dollar: DOWN at $1.2623 from $1.2632

Euro/pound: UP at 84.13 pence from 84.06 pence

Dollar/yen: UP at 129.23 yen from 129.05 yen

New York - Dow: UP 2.8 percent at 34,061.06 (close)

London - FTSE 100: DOWN 0.9 percent at 7,493.45 (close)

A.O.Scott--AT