-

Ghostwriters, polo shirts, and the fall of a landmark pesticide study

Ghostwriters, polo shirts, and the fall of a landmark pesticide study

-

Mixed day for global stocks as market digest huge Netflix deal

-

Fighting erupts in DR Congo a day after peace deal signed

Fighting erupts in DR Congo a day after peace deal signed

-

England boss Tuchel wary of 'surprise' in World Cup draw

-

10 university students die in Peru restaurant fire

10 university students die in Peru restaurant fire

-

'Sinners' tops Critics Choice nominations

-

Netflix's Warner Bros. acquisition sparks backlash

Netflix's Warner Bros. acquisition sparks backlash

-

France probes mystery drone flight over nuclear sub base

-

Frank Gehry: five key works

Frank Gehry: five key works

-

US Supreme Court to weigh Trump bid to end birthright citizenship

-

Frank Gehry, master architect with a flair for drama, dead at 96

Frank Gehry, master architect with a flair for drama, dead at 96

-

'It doesn't make sense': Trump wants to rename American football

-

A day after peace accord signed, shelling forces DRC locals to flee

A day after peace accord signed, shelling forces DRC locals to flee

-

Draw for 2026 World Cup kind to favorites as Trump takes center stage

-

Netflix to buy Warner Bros. in deal of the decade

Netflix to buy Warner Bros. in deal of the decade

-

US sanctions equate us with drug traffickers: ICC dep. prosecutor

-

Migration and crime fears loom over Chile's presidential runoff

Migration and crime fears loom over Chile's presidential runoff

-

French officer charged after police fracture woman's skull

-

Fresh data show US consumers still strained by inflation

Fresh data show US consumers still strained by inflation

-

Eurovision reels from boycotts over Israel

-

Trump takes centre stage as 2026 World Cup draw takes place

Trump takes centre stage as 2026 World Cup draw takes place

-

Trump all smiles as he wins FIFA's new peace prize

-

US panel votes to end recommending all newborns receive hepatitis B vaccine

US panel votes to end recommending all newborns receive hepatitis B vaccine

-

Title favourite Norris reflects on 'positive' Abu Dhabi practice

-

Stocks consolidate as US inflation worries undermine Fed rate hopes

Stocks consolidate as US inflation worries undermine Fed rate hopes

-

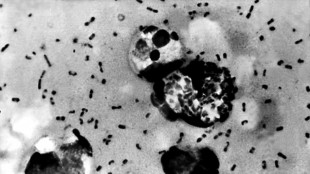

Volcanic eruptions may have brought Black Death to Europe

-

Arsenal the ultimate test for in-form Villa, says Emery

Arsenal the ultimate test for in-form Villa, says Emery

-

Emotions high, hope alive after Nigerian school abduction

-

Another original Hermes Birkin bag sells for $2.86 mn

Another original Hermes Birkin bag sells for $2.86 mn

-

11 million flock to Notre-Dame in year since rising from devastating fire

-

Gymnast Nemour lifts lid on 'humiliation, tears' on way to Olympic gold

Gymnast Nemour lifts lid on 'humiliation, tears' on way to Olympic gold

-

Lebanon president says country does not want war with Israel

-

France takes anti-drone measures after flight over nuclear sub base

France takes anti-drone measures after flight over nuclear sub base

-

Signing up to DR Congo peace is one thing, delivery another

-

'Amazing' figurines find in Egyptian tomb solves mystery

'Amazing' figurines find in Egyptian tomb solves mystery

-

Palestinians say Israeli army killed man in occupied West Bank

-

McLaren will make 'practical' call on team orders in Abu Dhabi, says boss Brown

McLaren will make 'practical' call on team orders in Abu Dhabi, says boss Brown

-

Stocks rise as investors look to more Fed rate cuts

-

Norris completes Abu Dhabi practice 'double top' to boost title bid

Norris completes Abu Dhabi practice 'double top' to boost title bid

-

Chiba leads Liu at skating's Grand Prix Final

-

Meta partners with news outlets to expand AI content

Meta partners with news outlets to expand AI content

-

Mainoo 'being ruined' at Man Utd: Scholes

-

Guardiola says broadcasters owe him wine after nine-goal thriller

Guardiola says broadcasters owe him wine after nine-goal thriller

-

Netflix to buy Warner Bros. Discovery in deal of the decade

-

French stars Moefana and Atonio return for Champions Cup

French stars Moefana and Atonio return for Champions Cup

-

Penguins queue in Paris zoo for their bird flu jabs

-

Netflix to buy Warner Bros. Discovery for nearly $83 billion

Netflix to buy Warner Bros. Discovery for nearly $83 billion

-

Sri Lanka issues fresh landslide warnings as toll nears 500

-

Root says England still 'well and truly' in second Ashes Test

Root says England still 'well and truly' in second Ashes Test

-

Chelsea's Maresca says rotation unavoidable

Wall Street rebounds, European stocks slump at end of volatile week

European stock markets ended a volatile week in the red of Friday, as investors weighed expectations of economic recovery against soaring inflation, rising interest rates and mixed earnings.

By contrast, Wall Street was in positive territory, and oil prices were steady.

The week has been dominated by investor concern that any possible interest rates by the US Federal Reserve -- as it seeks to rein in high inflation -- could choke off economic recovery following pandemic-induced lockdowns.

The European Central Bank, for its part, appears to be sitting tight for the time being, causing the euro to fall to a 19-month low against the dollar on Friday.

Rising tensions between Russia and the West over the Ukraine crisis have wiped around $7 trillion off stock market valuations across the globe so far this month.

"Downbeat mood rounds up a volatile week for markets," said Victoria Scholar, head of investment at Interactive Investor.

Wall Street was nevertheless in the black, with the tech-heavy NASDAQ rising by 1.4 percent after Apple unveiled record revenues.

Nevertheless, "inflation and tightening concerns exacerbated by surging oil prices and a hawkish Federal Reserve" continued to weigh on sentiment, said ThinkMarkets analyst, Fawad Razaqzada.

In Europe, Frankfurt and Paris ended the day in the red, even though France posted its strongest economist in more than 50 years, while German growth data disappointed.

The German economy shrank by 0.7 percent in the fourth quarter, but expanded by 2.8 percent over the year as a whole, the data showed, while in neighbouring France, economic growth reached seven percent.

In the US, inflation picked up to 4.9 percent in December from 4.7 percent in November.

"The consumer inflation rate is at a near 40-year high, wage pressures are building, supply chains are still tangled, oil prices are at a seven-year high, and more and more companies are talking about ongoing cost pressures," said Patrick O'Hare at Briefing.com.

While stock markets have rallied for the best part of two years, analysts said a hefty pullback can be expected, as investors take profit and central banks roll back massive pandemic-era stimulus.

Crude oil prices remained well-supported after a strong trading week, aided by the Ukraine-Russia crisis, with Brent rising above $91 per barrel.

"Russia's supply of natural gas to Western Europe could further spark volatility across financial markets, and as we turn the corner on the pandemic we now see a possible conflict as one of the biggest threats to markets in 2022," warned Federated Hermes analyst, Lewis Grant.

- Key figures around 1650 GMT -

New York - Dow: UP 0.2 percent at 34,227.14 points

London - FTSE 100: DOWN 1.1 percent at 7,466.07 (close)

Frankfurt - DAX: DOWN 0.5 percent at 15,356.16 (close)

Paris - CAC 40: DOWN 0.8 percent at 6,965.88 (close)

EURO STOXX 50: DOWN 1.1 percent at 4,137.74

Tokyo - Nikkei 225: UP 2.1 percent at 26,717.34 (close)

Hong Kong - Hang Seng Index: DOWN 1.1 percent at 23,550.08 (close)

Shanghai - Composite: DOWN 1.0 percent at 3,361.44 (close)

Euro/dollar: UP at $1.1165 from $1.1147

Pound/dollar: UP at $1.3413 from $1.3381

Euro/pound: DOWN at 83.24 pence from 83.27 pence

Dollar/yen: DOWN at 115.19 yen from 115.36 yen

Brent North Sea crude: UP 0.6 percent at $90.61 per barrel

West Texas Intermediate: UP 1.6 percent at $88.02 per barrel

burs-rl/cdw/spm

W.Nelson--AT