-

'No winner': Kosovo snap poll unlikely to end damaging deadlock

'No winner': Kosovo snap poll unlikely to end damaging deadlock

-

Culture being strangled by Kosovo's political crisis

-

Main contenders in Kosovo's snap election

Main contenders in Kosovo's snap election

-

Australia all out for 152 as England take charge of 4th Ashes Test

-

Boys recount 'torment' at hands of armed rebels in DR Congo

Boys recount 'torment' at hands of armed rebels in DR Congo

-

Inside Chernobyl, Ukraine scrambles to repair radiation shield

-

Bondi victims honoured as Sydney-Hobart race sets sail

Bondi victims honoured as Sydney-Hobart race sets sail

-

North Korea's Kim orders factories to make more missiles in 2026

-

Palladino's Atalanta on the up as Serie A leaders Inter visit

Palladino's Atalanta on the up as Serie A leaders Inter visit

-

Hooked on the claw: how crane games conquered Japan's arcades

-

Shanghai's elderly waltz back to the past at lunchtime dance halls

Shanghai's elderly waltz back to the past at lunchtime dance halls

-

Japan govt approves record 122 trillion yen budget

-

US launches Christmas Day strikes on IS targets in Nigeria

US launches Christmas Day strikes on IS targets in Nigeria

-

Australia reeling on 72-4 at lunch as England strike in 4th Ashes Test

-

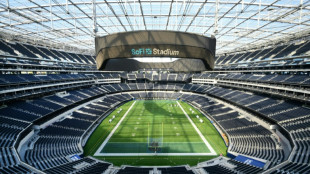

Too hot to handle? Searing heat looming over 2026 World Cup

Too hot to handle? Searing heat looming over 2026 World Cup

-

Packers clinch NFL playoff spot as Lions lose to Vikings

-

Guinea's presidential candidates hold final rallies before Sunday's vote

Guinea's presidential candidates hold final rallies before Sunday's vote

-

BondwithPet Expands B2B Offering with Custom Pet Memorial Product

-

Best Crypto IRA Companies (Rankings Released)

Best Crypto IRA Companies (Rankings Released)

-

Eon Prime Intelligent Alliance Office Unveils New Brand Identity and Completes Website Upgrade

-

Villa face Chelsea test as Premier League title race heats up

Villa face Chelsea test as Premier League title race heats up

-

Spurs extend domination of NBA-best Thunder

-

Malaysia's Najib to face verdict in mega 1MDB graft trial

Malaysia's Najib to face verdict in mega 1MDB graft trial

-

Russia makes 'proposal' to France over jailed researcher

-

King Charles calls for 'reconciliation' in Christmas speech

King Charles calls for 'reconciliation' in Christmas speech

-

Brazil's jailed ex-president Bolsonaro undergoes 'successful' surgery

-

UK tech campaigner sues Trump administration over US sanctions

UK tech campaigner sues Trump administration over US sanctions

-

New Anglican leader says immigration debate dividing UK

-

Russia says made 'proposal' to France over jailed researcher

Russia says made 'proposal' to France over jailed researcher

-

Bangladesh PM hopeful Rahman returns from exile ahead of polls

-

Police suspect suicide bomber behind Nigeria's deadly mosque blast

Police suspect suicide bomber behind Nigeria's deadly mosque blast

-

AFCON organisers allowing fans in for free to fill empty stands: source

-

Mali coach Saintfiet hits out at European clubs, FIFA over AFCON changes

Mali coach Saintfiet hits out at European clubs, FIFA over AFCON changes

-

Pope urges Russia, Ukraine dialogue in Christmas blessing

-

Last Christians gather in ruins of Turkey's quake-hit Antakya

Last Christians gather in ruins of Turkey's quake-hit Antakya

-

Pope Leo condemns 'open wounds' of war in first Christmas homily

-

Mogadishu votes in first local elections in decades under tight security

Mogadishu votes in first local elections in decades under tight security

-

Prime minister hopeful Tarique Rahman arrives in Bangladesh

-

'Starting anew': Indonesians in disaster-struck Sumatra hold Christmas mass

'Starting anew': Indonesians in disaster-struck Sumatra hold Christmas mass

-

Cambodian PM's wife attends funerals of soldiers killed in Thai border clashes

-

Prime minister hopeful Tarique Rahman arrives in Bangladesh: party

Prime minister hopeful Tarique Rahman arrives in Bangladesh: party

-

Pacific archipelago Palau agrees to take migrants from US

-

Pope Leo expected to call for peace during first Christmas blessing

Pope Leo expected to call for peace during first Christmas blessing

-

Australia opts for all-pace attack in fourth Ashes Test

-

'We hold onto one another and keep fighting,' says wife of jailed Istanbul mayor

'We hold onto one another and keep fighting,' says wife of jailed Istanbul mayor

-

North Korea's Kim visits nuclear subs as Putin hails 'invincible' bond

-

Trump takes Christmas Eve shot at 'radical left scum'

Trump takes Christmas Eve shot at 'radical left scum'

-

3 Factors That Affect the Cost of Dentures in San Antonio, TX

-

Leo XIV celebrates first Christmas as pope

Leo XIV celebrates first Christmas as pope

-

Diallo and Mahrez strike at AFCON as Ivory Coast, Algeria win

China lockdowns, rate hike fears batter stock markets

Stock markets sank Monday on growing concerns that lockdowns in China aimed at fighting a worsening Covid outbreak could threaten the country's economy and global supply chains.

The losses extended a sell-off across the world last week fuelled by comments from Federal Reserve boss Jerome Powell indicating officials will hike interest rates by half a point next month and possibly several times more by year's end.

China's struggle to get a grip on a Covid outbreak that has forced Shanghai -- the country's biggest city -- into lockdown and dealing a blow to demand.

Officials in the finance hub reported 51 deaths Monday, its highest daily toll despite weeks of strict containment measures, while Beijing warned of a "grim" situation as infections rise.

The lockdowns will "cause a logistical problem that's going to affect not just China but also the rest of the world", OANDA's Jeffrey Halley told Bloomberg TV.

Officials' determination to continue with a zero-Covid policy as well as a lack of government stimulus, "that all points to lower China stocks and we are going to see a weaker yuan going forward".

Investors were already fleeing risk assets as they become worried that the Fed tightening -- to fight inflation at more than 40-year highs -- will knock the pandemic economic recovery off course and dent companies' bottom line.

With earnings season under way, a close eye is being kept on what firms say about the impact on and the outlook for business in light of inflation, forecast rate hikes, supply chain snarls and the Ukraine war.

"Having spent most of the last few weeks trying to put to one side concerns about events in eastern Europe, a slowdown in China, and the increasing risks of what inflation might do to company earnings, as well as consumer incomes, the final straw appears to be a concern about the prospect of a policy mistake by central banks, and a possible recession by the end of the year," said Michael Hewson of CMC Markets.

And Geir Lode, at Federated Hermes, added: "There has been little to avert the investor pessimism as inflation and interest rate expectations start to bite.

"In particular due to the uncertainty of the macro environment, expectations are low with regard to forward estimates and guidance, building on lowered expectations from the previous quarter."

All three main indexes on Wall Street ended more than two percent down Friday, and Asia followed suit with hefty losses.

Hong Kong and Shanghai led the selling, with both markets suffering hefty losses, while Tokyo, Seoul, Singapore, Taipei, Mumbai, Bangkok and Jakarta were also deep in the red.

London, Paris and Frankfurt were sharply lower in the morning.

Sydney and Wellington were closed for holidays.

The hit to demand for energy in China also dragged on crude. WTI fell below $100 a barrel, even as the war in Ukraine hits supplies of the black gold owing to embargoes on Russian exports.

"Oil is rerating lower due to the China consumption hit while the Federal Reserve is raising interest rates to slow down the US economy," said Stephen Innes at SPI Asset Management.

"Those are two gusty headwinds suggesting some oil bulls will give way to recession fears and demand devastation."

On currency markets, the euro was unable to hold a brief rally that came on the back of Emmanuel Macron's victory in France's presidential election, seeing off far-right challenger Marine Le Pen.

- Key figures at 0810 GMT -

Tokyo - Nikkei 225: DOWN 1.9 percent at 26,590.78 (close)

Hong Kong - Hang Seng Index: DOWN 3.7 percent at 19,869.34 (close)

Shanghai - Composite: DOWN 5.1 percent at 2,928.51 (close)

London - FTSE 100: DOWN 1.7 percent at 7,393.58

Brent North Sea crude: DOWN 4.0 percent at $102.41 per barrel

West Texas Intermediate: DOWN 4.0 percent at $97.95 per barrel

Euro/dollar: DOWN at $1.0743 from $1.0801 late on Friday

Dollar/yen: DOWN at 128.21 yen from 128.51 yen

Pound/dollar: DOWN at $1.2754 from $1.2834

Euro/pound: UP at 84.23 pence from 84.14 pence

New York - Dow: DOWN 2.8 percent at 33,811.40 (close)

W.Moreno--AT