-

Former Montpellier coach Gasset dies at 72

Former Montpellier coach Gasset dies at 72

-

Trump's Christmas gospel: bombs, blessings and blame

-

Salah helps 10-man Egypt beat South Africa and book last-16 place

Salah helps 10-man Egypt beat South Africa and book last-16 place

-

Russia lashes out at Zelensky ahead of new Trump meeting on Ukraine plan

-

Salah helps Egypt beat South Africa and book last-16 place

Salah helps Egypt beat South Africa and book last-16 place

-

Australia's Ikitau facing lengthy lay-off after shoulder injury

-

Another 1,100 refugees cross into Mauritania from Mali: UN

Another 1,100 refugees cross into Mauritania from Mali: UN

-

Guardiola proud of Man City players' response to weighty issues

-

Deadly blast hits mosque in Alawite area of Syria's Homs

Deadly blast hits mosque in Alawite area of Syria's Homs

-

The Jukebox Man on song as Redknapp records 'dream' King George win

-

Liverpool boss Slot says Ekitike reaping rewards for greater physicality

Liverpool boss Slot says Ekitike reaping rewards for greater physicality

-

Judge jails ex-Malaysian PM Najib for 15 more years after new graft conviction

-

Musona rescues Zimbabwe in AFCON draw with Angola

Musona rescues Zimbabwe in AFCON draw with Angola

-

Zelensky to meet Trump in Florida on Sunday

-

'Personality' the key for Celtic boss Nancy when it comes to new signings

'Personality' the key for Celtic boss Nancy when it comes to new signings

-

Arteta eager to avoid repeat of Rice red card against Brighton

-

Nigeria signals more strikes likely in 'joint' US operations

Nigeria signals more strikes likely in 'joint' US operations

-

Malaysia's former PM Najib convicted in 1MDB graft trial

-

Elusive wild cat feared extinct rediscovered in Thailand

Elusive wild cat feared extinct rediscovered in Thailand

-

Japan govt approves record budget, including for defence

-

Malaysia's Najib convicted of abuse of power in 1MDB graft trial

Malaysia's Najib convicted of abuse of power in 1MDB graft trial

-

Seoul to ease access to North Korean newspaper

-

History-maker Tongue wants more of the same from England attack

History-maker Tongue wants more of the same from England attack

-

Australia lead England by 46 after 20 wickets fall on crazy day at MCG

-

Asia markets edge up as precious metals surge

Asia markets edge up as precious metals surge

-

Twenty wickets fall on day one as Australia gain edge in 4th Ashes Test

-

'No winner': Kosovo snap poll unlikely to end damaging deadlock

'No winner': Kosovo snap poll unlikely to end damaging deadlock

-

Culture being strangled by Kosovo's political crisis

-

Main contenders in Kosovo's snap election

Main contenders in Kosovo's snap election

-

Australia all out for 152 as England take charge of 4th Ashes Test

-

Boys recount 'torment' at hands of armed rebels in DR Congo

Boys recount 'torment' at hands of armed rebels in DR Congo

-

Inside Chernobyl, Ukraine scrambles to repair radiation shield

-

Bondi victims honoured as Sydney-Hobart race sets sail

Bondi victims honoured as Sydney-Hobart race sets sail

-

North Korea's Kim orders factories to make more missiles in 2026

-

Palladino's Atalanta on the up as Serie A leaders Inter visit

Palladino's Atalanta on the up as Serie A leaders Inter visit

-

Hooked on the claw: how crane games conquered Japan's arcades

-

Shanghai's elderly waltz back to the past at lunchtime dance halls

Shanghai's elderly waltz back to the past at lunchtime dance halls

-

Japan govt approves record 122 trillion yen budget

-

US launches Christmas Day strikes on IS targets in Nigeria

US launches Christmas Day strikes on IS targets in Nigeria

-

Australia reeling on 72-4 at lunch as England strike in 4th Ashes Test

-

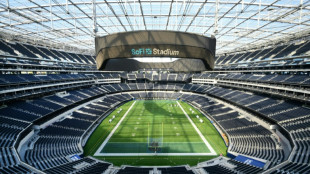

Too hot to handle? Searing heat looming over 2026 World Cup

Too hot to handle? Searing heat looming over 2026 World Cup

-

Packers clinch NFL playoff spot as Lions lose to Vikings

-

Guinea's presidential candidates hold final rallies before Sunday's vote

Guinea's presidential candidates hold final rallies before Sunday's vote

-

President Trump's Executive Marijuana Action Exposes the Truth-How the DEA Delayed Medicine While Protecting Everything Else

-

Calvin B. Taylor Bankshares, Inc. Reports Third Quarter Financial Results and Announces New Stock Repurchase Program

Calvin B. Taylor Bankshares, Inc. Reports Third Quarter Financial Results and Announces New Stock Repurchase Program

-

Processa Pharmaceuticals and 60 Degrees Pharmaceuticals Interviews to Air on the RedChip Small Stocks, Big Money(TM) Show on Bloomberg TV

-

Aptevo Therapeutics Announces 1-for-18 Reverse Stock Split

Aptevo Therapeutics Announces 1-for-18 Reverse Stock Split

-

Loar Holdings Inc. Announced The Completion of its Acquisition of LMB Fans & Motors

-

IRS Can Freeze Installment Agreements After Missed Filings - Clear Start Tax Explains Why Compliance Comes First

IRS Can Freeze Installment Agreements After Missed Filings - Clear Start Tax Explains Why Compliance Comes First

-

How the Terms of SMX's $111 Million Capital Facility Shape the Valuation Discussion

Ukraine crisis, inflation risks loom over ECB meeting

European Central Bank governors meet Thursday to ponder record-high inflation and fresh economic uncertainty caused by the war in Ukraine, with policymakers signalling a willingness to take action sooner rather than later.

At its last meeting in March, the ECB said it would accelerate the winding down of its bond-buying stimulus, with a view to ending the scheme in the third quarter.

An interest rate hike -- the ECB's first in over a decade -- would follow "some time" after that, it said.

But since then prices have continued to spiral, with costs for energy, commodities and food surging in the wake of the war in Ukraine, adding to fears that the conflict will stunt a post-Covid recovery.

The US Federal Reserve and the Bank of England have already announced their first rate hikes to combat price pressures, leaving the ECB looking out of step.

Inflation jumped to a record 7.5 percent in the euro area last month, well beyond the ECB's two-percent target.

Although no major policy changes are expected on Thursday, ECB chief Christine Lagarde's press conference will be scoured for clues of the bank shifting into more aggressive inflation-fighting mode.

"In our view, policymakers are likely to bring forward their plans to raise interest rates," said Capital Economics in a client note, "as inflation continues to surprise to the upside".

Lagarde tested positive for Covid-19 last week but is still set to chair the meeting and take part in the virtual press conference afterwards.

- 'Too late' -

Central bankers use interest rate rises as a tool to tame inflation, but pulling the trigger too soon risks hurting economic growth.

The ECB's dilemma has been complicated by Russia's invasion of Ukraine and Western sanctions against Moscow, as the fallout from the upheaval to international trade and energy markets remains difficult to predict.

Minutes from the last ECB meeting revealed that many members of the 25-member governing council wanted "immediate further steps" to tackle inflation despite the darkening economic picture.

Some governors called for ending the bond purchases in the summer, opening the door to a rate hike in the third quarter.

The minutes showed that the ECB "has become more hawkish", said ING bank economist Carsten Brzeski, describing those advocating for a tightening of monetary policy.

Joachim Nagel, the head of Germany's powerful Bundesbank central bank, is among several ECB members who have said they expect the first rate rises this year.

He has cautioned against "acting too late".

- Gloomy consumers -

The ECB has for years maintained an ultra-loose monetary policy, pushing interest rates to historic lows to stoke growth and drive up below-target inflation.

It even set a negative deposit rate of minus 0.5 percent, meaning banks pay to park excess cash at the ECB.

It has also hoovered up billions of euros in government and corporate bonds each month to keep credit flowing in the 19-nation currency club. The massive stimulus is now being phased out, a move the ECB always said would come before any interest rate changes.

Capital Economics analysts said they now expect the ECB to raise the deposit rate as early as July, followed by two more hikes before the end of the year.

Lagarde recently warned that higher energy costs as a result of Europe's reliance on Russian oil and gas would worsen Europe's cost-of-living squeeze.

Households were becoming more pessimistic, she said, and could cut back further on spending.

"The longer the war lasts, the higher the economic costs will be and the greater the likelihood we end up in more adverse scenarios," she said.

Lagarde, a former French finance minister, has urged European governments to help cushion the blow through fiscal policy.

France, Spain, Germany and other countries have already moved to ease the burden on households and companies, including through fuel tax cuts or subsidies for heating.

A.Ruiz--AT