-

Somalia denounces Israeli recognition of Somaliland

Somalia denounces Israeli recognition of Somaliland

-

The Cure guitarist and keyboard player Perry Bamonte dies aged 65

-

Draper to miss Australian Open

Draper to miss Australian Open

-

Former Ivory Coast coach Gasset dies at 72

-

Police arrest suspect after man stabs 3 women in Paris metro

Police arrest suspect after man stabs 3 women in Paris metro

-

Former Montpellier coach Gasset dies at 72

-

Trump's Christmas gospel: bombs, blessings and blame

Trump's Christmas gospel: bombs, blessings and blame

-

Salah helps 10-man Egypt beat South Africa and book last-16 place

-

Russia lashes out at Zelensky ahead of new Trump meeting on Ukraine plan

Russia lashes out at Zelensky ahead of new Trump meeting on Ukraine plan

-

Salah helps Egypt beat South Africa and book last-16 place

-

Australia's Ikitau facing lengthy lay-off after shoulder injury

Australia's Ikitau facing lengthy lay-off after shoulder injury

-

Another 1,100 refugees cross into Mauritania from Mali: UN

-

Guardiola proud of Man City players' response to weighty issues

Guardiola proud of Man City players' response to weighty issues

-

Deadly blast hits mosque in Alawite area of Syria's Homs

-

The Jukebox Man on song as Redknapp records 'dream' King George win

The Jukebox Man on song as Redknapp records 'dream' King George win

-

Liverpool boss Slot says Ekitike reaping rewards for greater physicality

-

Judge jails ex-Malaysian PM Najib for 15 more years after new graft conviction

Judge jails ex-Malaysian PM Najib for 15 more years after new graft conviction

-

Musona rescues Zimbabwe in AFCON draw with Angola

-

Zelensky to meet Trump in Florida on Sunday

Zelensky to meet Trump in Florida on Sunday

-

'Personality' the key for Celtic boss Nancy when it comes to new signings

-

Arteta eager to avoid repeat of Rice red card against Brighton

Arteta eager to avoid repeat of Rice red card against Brighton

-

Nigeria signals more strikes likely in 'joint' US operations

-

Malaysia's former PM Najib convicted in 1MDB graft trial

Malaysia's former PM Najib convicted in 1MDB graft trial

-

Elusive wild cat feared extinct rediscovered in Thailand

-

Japan govt approves record budget, including for defence

Japan govt approves record budget, including for defence

-

Malaysia's Najib convicted of abuse of power in 1MDB graft trial

-

Seoul to ease access to North Korean newspaper

Seoul to ease access to North Korean newspaper

-

History-maker Tongue wants more of the same from England attack

-

Australia lead England by 46 after 20 wickets fall on crazy day at MCG

Australia lead England by 46 after 20 wickets fall on crazy day at MCG

-

Asia markets edge up as precious metals surge

-

Twenty wickets fall on day one as Australia gain edge in 4th Ashes Test

Twenty wickets fall on day one as Australia gain edge in 4th Ashes Test

-

'No winner': Kosovo snap poll unlikely to end damaging deadlock

-

Culture being strangled by Kosovo's political crisis

Culture being strangled by Kosovo's political crisis

-

Main contenders in Kosovo's snap election

-

Australia all out for 152 as England take charge of 4th Ashes Test

Australia all out for 152 as England take charge of 4th Ashes Test

-

Boys recount 'torment' at hands of armed rebels in DR Congo

-

Inside Chernobyl, Ukraine scrambles to repair radiation shield

Inside Chernobyl, Ukraine scrambles to repair radiation shield

-

Bondi victims honoured as Sydney-Hobart race sets sail

-

North Korea's Kim orders factories to make more missiles in 2026

North Korea's Kim orders factories to make more missiles in 2026

-

Palladino's Atalanta on the up as Serie A leaders Inter visit

-

Hooked on the claw: how crane games conquered Japan's arcades

Hooked on the claw: how crane games conquered Japan's arcades

-

Shanghai's elderly waltz back to the past at lunchtime dance halls

-

Japan govt approves record 122 trillion yen budget

Japan govt approves record 122 trillion yen budget

-

US launches Christmas Day strikes on IS targets in Nigeria

-

Australia reeling on 72-4 at lunch as England strike in 4th Ashes Test

Australia reeling on 72-4 at lunch as England strike in 4th Ashes Test

-

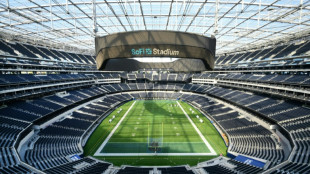

Too hot to handle? Searing heat looming over 2026 World Cup

-

Packers clinch NFL playoff spot as Lions lose to Vikings

Packers clinch NFL playoff spot as Lions lose to Vikings

-

Guinea's presidential candidates hold final rallies before Sunday's vote

-

TGI Solar Power Group Inc. and Genesys Info X Announce Strategic Partnership to Launch FUSED88.com, a Next-Generation AI & ASI Driven Management Platform

TGI Solar Power Group Inc. and Genesys Info X Announce Strategic Partnership to Launch FUSED88.com, a Next-Generation AI & ASI Driven Management Platform

-

When Capital Risk Disappears: The New Valuation Lens for SMX

US recession fears grow as Fed plots aggressive course

The Federal Reserve has made clear it will come out guns blazing to battle the highest inflation rate in four decades, but that has sparked increasing fears their campaign will plunge the world's largest economy into recession.

The US central bank is facing a daunting task as it tries to engineer a "soft landing" that preserves growth while tamping down worrying price pressures against an uncertain global backdrop.

It will require "exquisite calibration," longtime Fed watcher David Wessel told AFP.

The United States has roared back from the Covid-19 pandemic, posting solid growth and record job gains thanks to massive government aid and aggressive stimulus from the Fed, which cut the benchmark lending rate to zero in March 2020.

But the rebound has hit multiple stumbling blocks, including renewed waves of the virus and shortages of key supplies and workers that sent prices surging. It must also now navigate the fallout from the war in Ukraine, which has caused a jump in oil prices.

The Fed last month raised interest rates by a quarter point in the first of a series of increases, and since then a chorus of officials -- including Fed Chair Jerome Powell and Governor Lael Brainard -- have signaled their openness to half-point rate increases, a more aggressive measure.

Wessel, director of the Hutchins Center on Fiscal and Monetary Policy at the Brookings Institution, cautioned that the Fed's tough stance means policymakers are "more likely to overdo it than under do it."

The Fed was caught by surprise at the speed with which inflation spiked late last year, initially driven by prices for cars and housing before spreading into other categories.

Consumer prices jumped 7.9 percent in February, the highest annual increase since 1982, but spending has nonetheless remained robust even amid new coronavirus variants.

Higher borrowing costs work by dampening consumer and business spending, bringing demand more in line with supply to lower prices.

Red-hot housing demand has already cooled as mortgage rates rose in anticipation of the Fed hikes, and data this week from the Mortgage Bankers Association indicate lenders are tightening credit availability.

- 'Very careful' -

Global stock markets have sagged in recent days amid the tough talk from Fed officials -- including from Brainard, who this week called fighting inflation "paramount."

Economists agree the Fed's stance is appropriate to prevent high inflation from becoming embedded, eroding purchasing power and eating into recent wage gains.

The situation raises the specter of the 1980s, when a wage and price spiral and oil embargo from OPEC member states prompted then-Fed chief Paul Volcker to crank up interest rates, which ground down inflation but caused a recession.

But Dana Peterson, chief economist at The Conference Board, said the current situation is "very different," notably because the economy and labor market are strong, and the Fed has built up its inflation-fighting credibility.

While the recession angst is understandable, "We need to give the Fed some credit," Peterson told AFP.

Policymakers are looking at all the factors "and really want to calibrate this" to achieve a soft landing, and she predicted the Fed "will do everything in its power, not to 'go too far.'"

But she cautioned that the central bank cannot control the supply shocks that have hit the economy, including the ongoing pandemic.

- Offloading bond holdings -

Economists are expecting several rate hikes this year and next, including multiple half-point increases, with the first of those likely coming in early May when the policy-setting Federal Open Market Committee (FOMC) next meets.

The Fed also has another tool to deploy this time, which is to reduce their massive bond holdings built up during the pandemic that were meant to ensure financial markets had ample cash to support the economy.

The minutes of last month's FOMC meeting released Wednesday indicated the $9 trillion balance sheet could be reduced by $95 billion a month, a much faster pace than in the wake of the 2008 global financial crisis.

But as an untested policy tool, it is unclear how that will interact with rate hikes.

"It's tricky," Wessel said, but given the strength of the economy "a mild and short recession... might be a tradeoff that policymakers are willing to make" to vanquish inflation.

H.Gonzales--AT