-

Last-gasp Demirovic strike sends Stuttgart fourth

Last-gasp Demirovic strike sends Stuttgart fourth

-

Sesko strikes to rescue Man Utd, Villa beaten by Brentford

-

'At least 200' feared dead in DR Congo landslide: government

'At least 200' feared dead in DR Congo landslide: government

-

Coventry says 'sad' about ICE, Wasserman 'distractions' before Olympics

-

In-form Lyon make it 10 wins in a row

In-form Lyon make it 10 wins in a row

-

Man Utd strike late as Carrick extends perfect start in Fulham thriller

-

Van der Poel romps to record eighth cyclo-cross world title

Van der Poel romps to record eighth cyclo-cross world title

-

Mbappe penalty earns Real Madrid late win over nine-man Rayo

-

Resurgent Pakistan seal T20 sweep of Australia

Resurgent Pakistan seal T20 sweep of Australia

-

Fiji top sevens standings after comeback win in Singapore

-

Alcaraz sweeps past Djokovic to win 'dream' Australian Open

Alcaraz sweeps past Djokovic to win 'dream' Australian Open

-

Death toll from Swiss New Year bar fire rises to 41

-

Alcaraz says Nadal inspired him to 'special' Australian Open title

Alcaraz says Nadal inspired him to 'special' Australian Open title

-

Pakistan seeks out perpetrators after deadly separatist attacks

-

Ukraine war talks delayed to Wednesday, Zelensky says

Ukraine war talks delayed to Wednesday, Zelensky says

-

Djokovic says 'been a great ride' after Melbourne final loss

-

Von Allmen storms to downhill win in final Olympic tune-up

Von Allmen storms to downhill win in final Olympic tune-up

-

Carlos Alcaraz: tennis history-maker with shades of Federer

-

Alcaraz sweeps past Djokovic to win maiden Australian Open title

Alcaraz sweeps past Djokovic to win maiden Australian Open title

-

Israel says partially reopening Gaza's Rafah crossing

-

French IT giant Capgemini to sell US subsidiary after row over ICE links

French IT giant Capgemini to sell US subsidiary after row over ICE links

-

Iran's Khamenei likens protests to 'coup', warns of regional war

-

New Epstein accuser claims sexual encounter with ex-prince Andrew: report

New Epstein accuser claims sexual encounter with ex-prince Andrew: report

-

Italy's extrovert Olympic icon Alberto Tomba insists he is 'shy guy'

-

Chloe Kim goes for unprecedented snowboard halfpipe Olympic treble

Chloe Kim goes for unprecedented snowboard halfpipe Olympic treble

-

Pakistan combing for perpetrators after deadly separatist attacks

-

Israel partially reopens Gaza's Rafah crossing

Israel partially reopens Gaza's Rafah crossing

-

Iran declares European armies 'terrorist groups' after IRGC designation

-

Snowstorm disrupts travel in southern US as blast of icy weather widens

Snowstorm disrupts travel in southern US as blast of icy weather widens

-

Denmark's Andresen swoops to win Cadel Evans Road Race

-

Volkanovski beats Lopes in rematch to defend UFC featherweight title

Volkanovski beats Lopes in rematch to defend UFC featherweight title

-

Sea of colour as Malaysia's Hindus mark Thaipusam with piercings and prayer

-

Exiled Tibetans choose leaders for lost homeland

Exiled Tibetans choose leaders for lost homeland

-

Afghan returnees in Bamiyan struggle despite new homes

-

Mired in economic trouble, Bangladesh pins hopes on election boost

Mired in economic trouble, Bangladesh pins hopes on election boost

-

Chinese cash in jewellery at automated gold recyclers as prices soar

-

Israel to partially reopen Gaza's Rafah crossing

Israel to partially reopen Gaza's Rafah crossing

-

'Quiet assassin' Rybakina targets world number one after Melbourne win

-

Deportation raids drive Minneapolis immigrant family into hiding

Deportation raids drive Minneapolis immigrant family into hiding

-

Nvidia boss insists 'huge' investment in OpenAI on track

-

'Immortal' Indian comics keep up with changing times

'Immortal' Indian comics keep up with changing times

-

With Trump mum, last US-Russia nuclear pact set to end

-

In Sudan's old port of Suakin, dreams of a tourism revival

In Sudan's old port of Suakin, dreams of a tourism revival

-

Narco violence dominates as Costa Rica votes for president

-

Snowstorm barrels into southern US as blast of icy weather widens

Snowstorm barrels into southern US as blast of icy weather widens

-

LA Olympic chief 'deeply regrets' flirty Maxwell emails in Epstein files

-

Rose powers to commanding six-shot lead at Torrey Pines

Rose powers to commanding six-shot lead at Torrey Pines

-

BusinessHotels Launches AI Hotel Price Finder for Real-Time Rate Verification

-

Sidekick Tools Announces Upcoming Depop OTL and WhatNot Follow Features Alongside AI Updates

Sidekick Tools Announces Upcoming Depop OTL and WhatNot Follow Features Alongside AI Updates

-

Remotify CEO Maria Sucgang Recognized as Tatler Gen.T Leader of Tomorrow

Art's Way Improves Profitability Despite Ongoing AG Market Headwinds

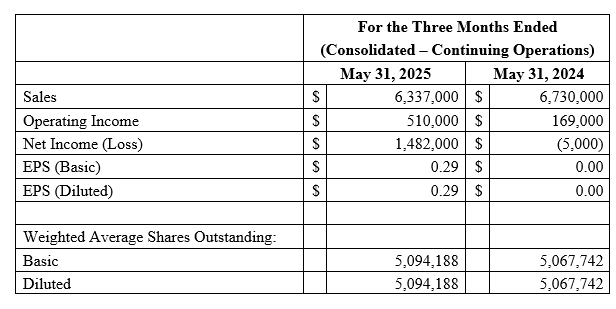

ARMSTRONG, IA / ACCESS Newswire / July 10, 2025 / Art's Way Manufacturing Co., Inc. (NASDAQ:ARTW) (the "Company"), a diversified manufacturer and distributor of equipment serving agricultural and research needs, announces its financial results for the second quarter of fiscal 2025.

President, CEO and Chairman Marc McConnell reports, "We are pleased to show operational progress and improved profitability during our second quarter despite challenging market conditions in the ag equipment space. During the quarter, we benefited greatly from sustained performance from our Modular Buildings segment while our Agricultural Products segment continued to see modest demand. We remain focused on enhancing our products and customer experience while also further improving our balance sheet and cashflow positions. We are pleased with our progress on these fronts and believe we are on firm footing to work through the uncertainty of the current environment with cautious optimism."

Consolidated - continuing operations

Sales of $6,337,000 for Q2 2025, 5.8% decline from Q1 2024. Six-month sales of $11,478,000, 7.8% decline from the first six months of fiscal 2024.

Six-month gross profit improvement of 3.8% compared to the first six months of fiscal 2024.

Operating expenses reduced by 15.3% for the six months ending May 31, 2025 compared to the same period in fiscal 2024.

Net income of $1,426,000 for the six months ending May 31, 2025, $1,855,000 improvement from same period in fiscal 2024. We received an Employee Retention Credit refund during the six months ending May 31, 2025 that positively impacted net income by $1,154,000.

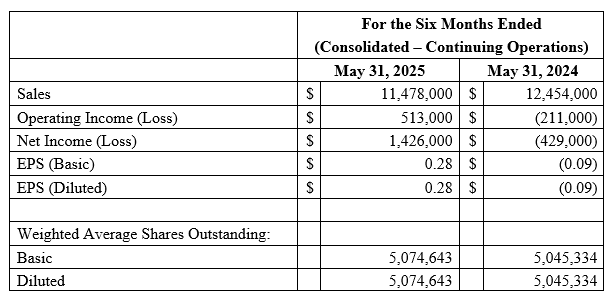

Agricultural Products

Sales of $4,025,000 for Q2 2025, a 11.6% decline from Q2 2024. Six-month sales of $6,973,000, 20.7% decline from the first six months of fiscal 2024.

Six-month gross profit declined 1.0% compared to the first six months of fiscal 2024.

Operating expenses reduced by 24.2% for the six months ending May 31, 2025 compared to the same period in fiscal 2024.

Net income of $527,000 for the six months ending May 31, 2025, improvement of $1,236,000 from same period in fiscal 2024. We received an Employee Retention Credit refund during the six months ending May 31, 2025 that positively impacted net income by $976,000 in this segment.

Weakened row crop prices and high interest rates continued to make for a difficult agricultural market through the first six months of fiscal 2025. Livestock prices, predominately cattle, are at all time highs in fiscal 2025 and have driven strong grinder mixer sales activity thus far in fiscal 2025. While we have seen quite a bit of destocking from heightened levels in fiscal 2024, many dealers are not eager to replace their stock at current interest rate levels. The agriculture market is highly cyclical, and we still believe we are at the bottom of the cycle. We anticipate that conditions will improve in the next 12 to 18 months in our market. Our efforts in fiscal 2024 to right-size our production and administrative staff has reduced our operating expenses, which is aiding in our efforts to weather the bottom of the cycle. In Q3 of fiscal 2025, we expect to be building stock inventory in order to react to retail opportunities in the second half of fiscal 2025. We will continue to release product specific programs in the second half of fiscal 2025 to turn inventory and unlock cash from product lines where our inventory levels are higher, which has been successful so far in fiscal 2025. We are seeing steel prices rise as tariff uncertainty impacts domestic demand. We expect U.S.-based steel manufacturers to be able to increase production to meet ongoing demand and note the presence of a major U.S. investment by Nippon Steel for a new US Steel mill. The United States currently imports approximately 25% of steel used by industry with Canada, Brazil and Mexico being the top suppliers. The majority of our manufacturing components are sourced in the U.S., however, some of our suppliers do source some of their components from China and other countries. We have also been seeing tariff charges from some of these suppliers and expect some minor impact from these tariffs on our gross profit.

Modular Buildings

Sales of $2,312,000 for Q2 2025, up 6.3% from Q2 2025. Six-month sales of $4,505,000, 23.0% increase from the first six months of fiscal 2024.

Six-month gross profit improvement of 12.2% compared to the first six months of fiscal 2024.

Operating expenses increased by 35.0% for the six months ending May 31, 2025 compared to the same period in fiscal 2024.

Net income of $899,000 for the six months ending May 31, 2025, improvement of $619,000 from the same period in fiscal 2024. We received an Employee Retention Credit refund in six months ending May 31, 2025 that positively impacted net income by $179,000 in this segment.

Demand for our modular buildings continues to be strong in fiscal 2025. Our expertise and execution in the custom research and laboratory market has established us as an industry leader. There continues to be a copious amount of quoting activity and custom build inquiries in fiscal 2025, despite some concerns about governmental grants and funding. In Q1 of fiscal 2025, we brought on a Director of Business Development and Sales who is transitioning to replace our retiring President and Director of Sales. The overlap in these positions in fiscal 2025 is providing additional sales capacity for us in fiscal 2025. We also expect to utilize our outgoing President and Director of Sales as a consultant moving forward to improve sales and maintain customer relationships. We are utilizing the transition period to explore new markets where our custom building can offer competitiveness to the marketplace.

Income (Loss) per Share: Income per basic and diluted share for the first six months of fiscal 2025 was $0.28, compared to loss per basic and diluted share of $0.09 for the same period in fiscal 2024.

Art's-Way Manufacturing Co., Inc.

Art's Way Manufacturing is a small, publicly traded company that specializes in equipment manufacturing. For over 65 years, it has been committed to designing and building high-quality machinery for all operations. It has approximately 100 employees across two branch locations: Art's Way Manufacturing in Armstrong, Iowa and Art's Way Scientific in Monona, Iowa. Art's Way manure spreaders, forage boxes, high dump carts, bale processors, graders, land planes, sugar beet harvesters and grinder mixers are designed to optimize production, increase efficiency and meet the growing demands of customers. Art's Way Manufacturing has two reporting segments: Agricultural Products and Modular Buildings.

For more information, contact: Marc McConnell, President, Chief Executive Officer and Chairman

712-208-8467

[email protected]

Or visit the Company's website at www.artsway.com/

Caution Regarding Forward-Looking Statements

This release includes "forward-looking statements" within the meaning of the federal securities laws. In some cases you can identify forward-looking statements by the use of words such as "may," "should," "anticipate," "believe," "expect," "plan," "future," "intend," "could," "estimate," "predict," "hope," "potential," "continue," "foresee," or the negative of these terms or other similar expressions. Statements made in this release that are not strictly statements of historical facts, including the Company's expectations regarding: (i) the Company's business position; (ii) demand and potential growth within the Company's business segments; (iii) future results, including but not limited to, revenue and margin expectations, expectations with respect to the impact of price increases, and expectations with respect to backlog and product mix; (iv) the Company's ability to increase production with capital investments and other activities, (v) future agricultural sales and plans to enter into building contracts; (vi) cash flows and plans to fund strategic initiatives and pay down debt; and (vii) the benefits of the Company's business model and strategy, are forward-looking statements. Statements of anticipated future results are based on current expectations and are subject to a number of risks and uncertainties, including, but not limited to: customer demand for the Company's products; credit-worthiness of the Company's customers; the Company's ability to operate at lower expense levels; the Company's ability to complete projects in a timely and efficient manner in accordance with customer specifications; the Company's ability to renew or obtain financing on reasonable terms; the Company's ability to repay current debt, continue to meet debt obligations and comply with financial covenants; inflation and tariffs and their effect on the Company's supply chain and demand for its products; domestic and international economic conditions; the Company's ability to attract and maintain an adequate workforce in a competitive labor market; factors affecting the strength of the agricultural sector; the cost of raw materials; unexpected changes to performance by any of the Company's operating segments; and other factors detailed from time to time in the Company's Securities and Exchange Commission filings. Actual results may differ markedly from management's expectations. Readers are cautioned not to place undue reliance upon any such forward-looking statements. The Company does not intend to update forward-looking statements other than as required by law.

SOURCE: Art's-Way Manufacturing Co.

View the original press release on ACCESS Newswire

R.Lee--AT